To a man whose only tool is a hammer, pretty soon everything begins to look like a nail.

I couldn’t help but be reminded of that aphorism as I read the most popular article on WSJ.com yesterday — Tax Hikes and the 2011 Economic Collapse — a screed on the Laffer curve and Supply Side Economics by none then than Art Laffer.

If either the WSJ OpEd page or Mr. Laffer had foreseen the most recent economic collapse we just lived through, or the credit crisis, or the housing collapse, or the derivatives problem, or any of the other economic disasters that befell the country I might give their warnings some credence. (I give credit to Laffer for discussing the possibility of a recession in Feb 2008 — way ahead of most right wing economists) But considering all this occurred with their man in the White House for 8 years, and they somehow missed it, leads me to one of two conclusions: Either they are extremely bad economists, or they are extremely partisan observers.

Given that so many of the dismal set missed all of the above, we should give them the benefit of the doubt. Let’s not simply assume they are bad economists — instead, this looks like just another money-losing partisan screed.

In his OpEd, Mr. Laffer confuses causation with correlation, ignores market history, makes spurious argument, and simply make up crap as he goes along.

It is, to any thinking person, an embarrassment. Consider:

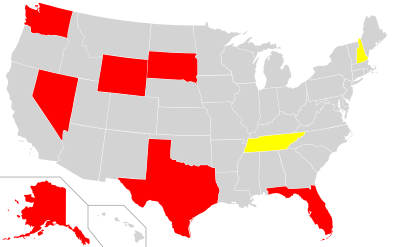

• “The nine states without an income tax are growing far faster and attracting more people than are the nine states with the highest income tax rates.”

This is mostly true, but misleading.

First, 7 states have no income tax; the other two tax — New Hampshire and Tennessee — only tax dividends and interest income.

Many of the states without income taxes — think Texas, and Alaska — are blessed with natural resources. (Nevada’s blessing is Innumeracy). They don’t have income taxes because the lease licenses to the mining and oil industry throw off so much revenue, that these taxes are not needed. Confusing correlation for causation is a Freshman college error, and we should expect better from Laffer.

Note: 5 of the 9 have a corporate business tax: Alaska has a state corporate income tax, Florida has a corporate income tax (5%); New Hampshire has a Business Profits Tax (8.5%); South Dakota has a financial institutions income tax; Washington has a Business and Occupation Tax. Since these are the fastest growing states according to Laffer, is the lesson to other states to add a corporate tax?

• “Bill Gates and Warren Buffett—hold the bulk of their wealth in the nontaxed form of unrealized capital gains?”

What unmitigated and embarrassing nonsense.

As everyone else in America is well, aware, both Gates and Buffett have committed their vast wealth to charitable foundations. Hence, the issue of “nontaxed unrealized capital gains” is simply irrelevant.

And of course, Laffer is aware of this — he is simply engaging in pedantic rhetoric when he makes this claim. (I believe the vernacular term for this form of argumentation is “full of shit.”)

It really throws a monkey wrench into the ideological dogma when the wealthiest Americans, those who have benefited the most from economic freedom and entrepreneurial opportunities recognize and criticize the growing wealth disparity in America as a very real problem.

• “At the tax boundary of Jan. 1, 1983 the economy took off like a rocket, with average real growth reaching 7.5% in 1983 and 5.5% in 1984.”

Again, factually accurate but totally misleading.

Reagan had the good fortune to take office at the tail end of a 16 year secular bear market, just as Paul Volcker fed the economy its distasteful medicine. Inflation was broken, and interest rates began their 25 year slide towards zero.

To ignore the reality of these factors, and credit tax cuts as the sole cause of the 1980s and 90s expansion is simply to discard reality because it does not fit your neat ideological universe. That is a surefire recipe for losing money as an investor . . .

• “Today, corporate profits as a share of GDP are way too high given the state of the U.S. economy”

After their many deductions, special legislative favors, un-repatrioted overseas profits, and too clever by half accounting, US corporations pay a very small percentage of their profits as taxes.

Decades of lobbying has created massive loopholes. Consider the total taxes paid to the US Treasury by any of the major banks and brokerages, the special tax treatment for hedge fund managers, the energy industry deductions, inadequate licensing revenue, etc.

This isn’t a question of MORE taxes — but basic Tax fairness. When American firms don’t pay their fair share of taxes, that means American citizens must make up the difference.

If you are against high taxes, you may want to consider what the total corporate tax base of America has looked like over the past 30 years — as profitability continues to go higher.

It is not just me who noticed the absurdity of the OpEd, Northern Trust’s Asha Banglore also calls out Mr. Laffer’s analysis as wanting:

“Assuming the tax cuts are allowed to expire, the forces that may prevent strong economic growth in 2011 are entirely different from tax increases. The headwinds from the financial sector, by way of a severe credit crunch, lackluster job growth, and housing market challenges are factors that will influence the near term path of the economy. The evidence presented here suggests that Mr. Laffer’s story is selective and incomplete…”

Basing your investments on “selective and incomplete” analyses is how you lose money in the captial markets.

Indeed, I have railed in these pages against the ideological, fact-free OpEd in the WSJ — not because of the politics, but because they have been such consistent money losers. That would not matter so much if it were the NYT or the Podunk Press, but this is the Journal, for crying out loud, It is supposed to be the paper of record for investors.

That the money losing OpEd page of the WSJ produces its most well read articles goes a long way in explaining one thing: Why 80% of money managers underperfom every year. Filling your head with Ideology, becoming a “magical thinker,” ignoring data, making up your own facts — these are a recipe for under-performing asset managers.

If I were to create a list of questions to ask potential managers of my money, one of them would be: “Do you read the WSJ OpEds?”

If the answer were yes, I would not walk but run in the opposite direction.

>

Ignore the prior bear market and Paul Volcker — nothing matters but Tax Cuts!

>

Previously:

Revisiting “The Obama Economy” (March 4th, 2010)

http://www.ritholtz.com/blog/2010/03/revisiting-the-obama-economy/

WSJ Jumps the Shark (January 22nd, 2010)

http://www.ritholtz.com/blog/2010/01/wsj-jumps-the-shark/

Source:

Tax Hikes and the 2011 Economic Collapse

ARTHUR LAFFER

WSJ, JUNE 7, 2010

http://online.wsj.com/article/SB10001424052748704113504575264513748386610.html

What's been said:

Discussions found on the web: