The New York Time’s David Leonhardt has the perfect article for the layperson who wants to understand the current debate between the deficit hawks and the stimulus advocates:

“The policy mistakes of the 1930s stemmed mostly from ignorance. John Maynard Keynes was still a practicing economist in those days, and his central insight about depressions — that governments need to spend when the private sector isn’t — was not widely understood. In the 1932 presidential campaign, Franklin D. Roosevelt vowed to outdo Herbert Hoover by balancing the budget. Much of Europe was also tightening at the time.

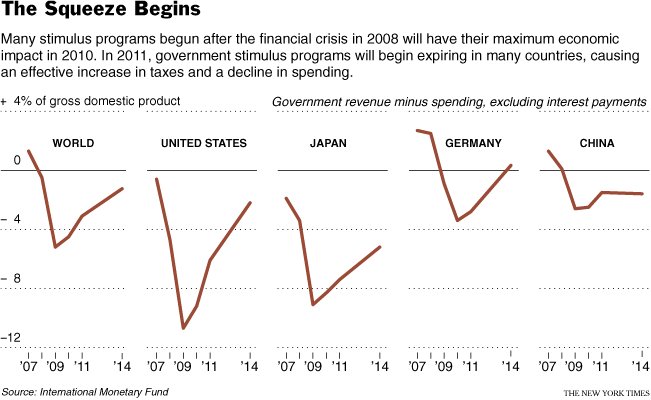

If anything, the initial stages of our own recent crisis were more severe than the Great Depression. Global trade, industrial production and stocks all dropped more in 2008-9 than in 1929-30, as a study by Barry Eichengreen and Kevin H. O’Rourke found.

In 2008, though, policy makers in most countries knew to act aggressively. The Federal Reserve and other central banks flooded the world with cheap money. The United States, China, Japan and, to a lesser extent, Europe, increased spending and cut taxes.”

Given that, what is the issue for the austerity debate today?

“The reasons vary by country. Greece has no choice. It is out of money, and the markets will not lend to it at a reasonable rate. Several other countries are worried — not ludicrously — that financial markets may turn on them, too, if they delay deficit reduction. Spain falls into this category, and even Britain may.

Then there are the countries that still have the cash or borrowing ability to push for more growth, like the United States, Germany and China, which happen to be three of the world’s biggest economies. Yet they are also reluctant.

China, until recently at least, has been worried about its housing market overheating. Germany has long been afraid of stimulus, because of inflation’s role in the Nazis’ political rise. In responding to the recent financial crisis, Europe, led by Germany, was much more timid than the United States, which is one reason the European economy is in worse shape today.

The reasons for the new American austerity are subtler, but not shocking. Our economy remains in rough shape, by any measure. So it’s easy to confuse its condition (bad) with its direction (better) and to lose sight of how much worse it could be. The unyielding criticism from those who opposed stimulus from the get-go — laissez-faire economists, Congressional Republicans, German leaders — plays a role, too. They’re able to shout louder than the data.

The whole piece is well worth a read . . .

>

>

Source:

Governments Moving to Cut Spending, in Echo of 1930s

DAVID LEONHARDT

NYT, June 29, 2010

http://www.nytimes.com/2010/06/30/business/economy/30leonhardt.html

What's been said:

Discussions found on the web: