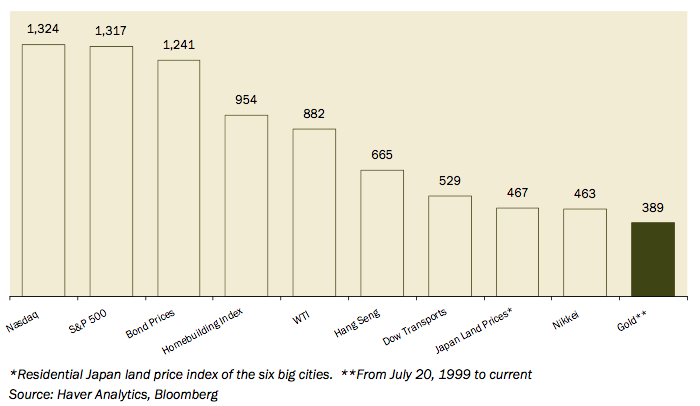

David Rosenberg offers us this thought provoking chart comparing the Gold rally with, well everything else.

The implication being, Gold has much further to run:

>

GOLD RALLY IN CONTEXT WITH PRIOR SECULAR BULL MARKETS

measuring trough-to-peak percent change

courtesy of Gluskin Sheff

What's been said:

Discussions found on the web: