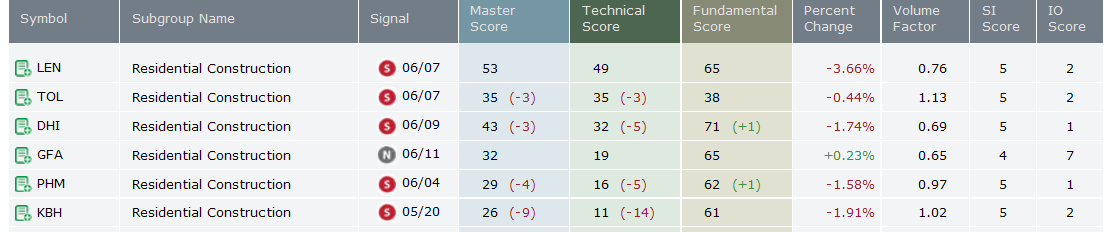

I was just discussing how ugly the Home builders look with AJ, one of our institutional sales traders.

Nearly every builder has been on a SELL SIGNAL in the Fusion IQ ranking system for several weeks now. These names are down 20 to 35% over that time.

AJ has been flashing TOL to various institutional clients as a possible short, but all of the builders — DHI, KBH, LEN, PLT — look pretty punk.

Considering we are now in the early stages of a second leg down in Housing, plus the excess new and shadow inventory that is out there, its hard to consider anything other than selling these names. Clients who are short have been advised not to cover yet.

>

Residential Construction Member Names and Rankings

>

D.R. Horton (DHI)

Other Homebuilders’ charts after the jump . . .

>

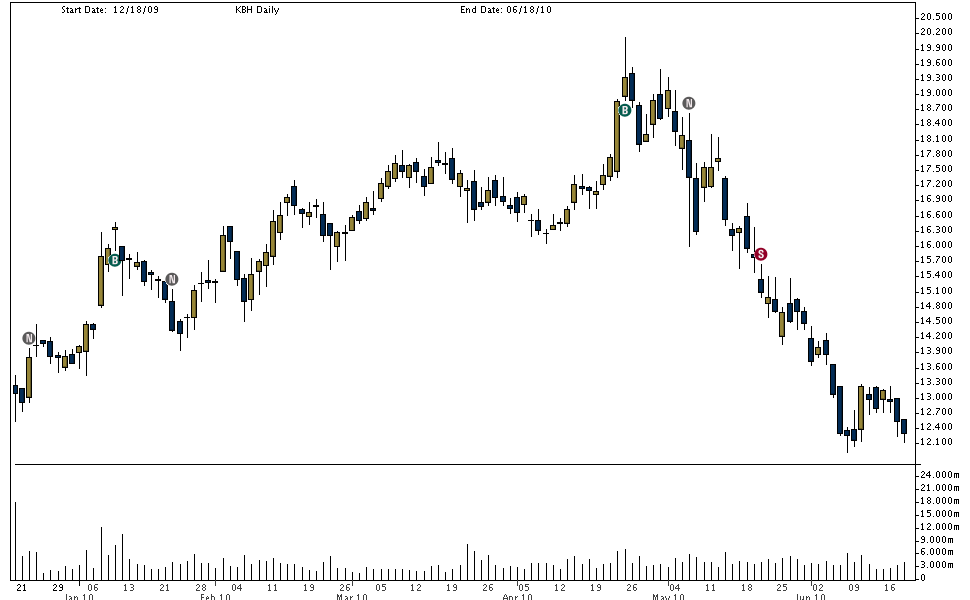

KB HOME (KBH)

>

Lennar Corporation (LEN)

>

PulteGroup (PHM)

>

What's been said:

Discussions found on the web: