Today is likely to be a very unusual Non Farm Payroll report. The reason why lay in the combination of several unusual factors, combined with the ongoing economic recovery from the worst recession in decades.

The median forecast of economists surveyed by Bloomberg News is for 536,000. That number would be the most since 1983. As we discuss below, we could see an even higher number.

Before we take a closer look at the details, a caveat: Regular readers know I don’t think much of the monthly NFP data. Identifying the precise monthly changes in a 143 million person labor pool is essentially an exercise in futility: Too much noise relative to signal gets run through a subjectively flawed model, subject to large, revisions to correct the consistent tracking error. What comes out of this sausage factory is little more than a rounding error.

This does not mean, however, that NFP is worthless. We care about two factors: 1) The overall trend, and 2) internal Employment Situation components such as Hours Worked, Temp Help, and Wages.

Which leads us to today. Consider the following elements which could go into an upside surprise:

• ADP Private payroll report was 55,000. But ADP has consistently been understating the BLS data, by 100-150k per month. (They keep revising their numbers upwards). That implies a private payroll number of 150-200k.

• The Labor Department showed ~417,000 more census workers were hired during the employment survey week (5/12) versus April.

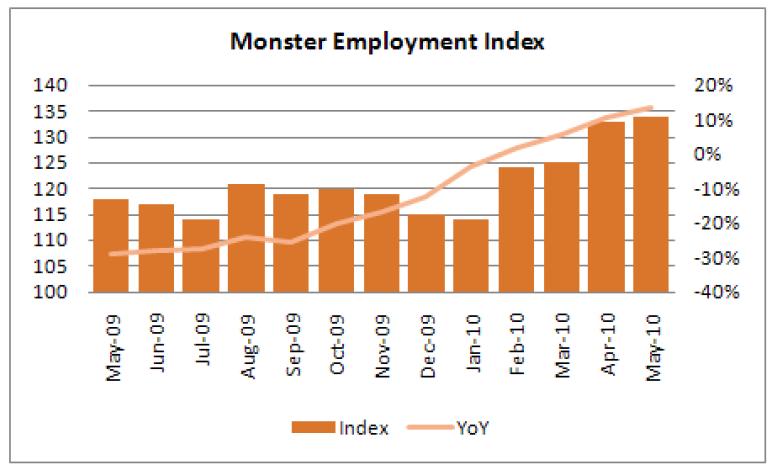

• The Monster Employment Index year-over-year growth rate climbed for the fourth consecutive month in May — and is now 14% (16 points) above the May 2009 index of 118. (See chart below). The index showed rising demand in 12 of the 20 industries, and 15 of 28 metro areas tracked by Monster showed greater online jobs demand.

• Birth Death adjustments for the month of May have tended to be fairly generous, typically coming in at 200k or better. (B/D goes into the total employment pool, not the monthly change in NFP)

• Other factors: New claims for unemployment insurance fell for the second straight week; Factories, Autos and Retailers have been showing ongoing strength in recent months. They will also be contributing to a positive number. Last, the President and VP have been publicly discussing the data — so you have to assume they got an early look, and liked what they saw.

We don’t make regular NFP forecasts, because the data is so subject to revisions, making the guessing process an exercise in futility. But given the unusual circumstances, I wanted to point out what might be an upside surprise.

Crunch the numbers of all of the above, and I calculate we could actually see a NFP number of 650-750k.

One final note: BLS is hosting a webchat today for those folks who want more info on the methodology.

~~~

What's been said:

Discussions found on the web: