There is an interesting (albeit wonky) discussion in this month’s Monetary Trends, published by the Federal Reserve Bank of St. Louis. Its titled The First U.S. Quantitative Easing: The 1930s.

Excerpt:

“The term “quantitative easing” became popular jargon in 2009. After setting the target for the federal funds rate at a range of zero to 25 basis points on December 28, 2008, the Federal Open Market Committee announced its intent to purchase up to approximately $1.7 trillion of agency debt, agency-guaranteed mortgage-backed securities, and Treasury securities. The Treasury collaborated, buying for its own account approximately $220 billion in agency mortgage-backed securities during 2009. This policy was labeled quantitative easing.

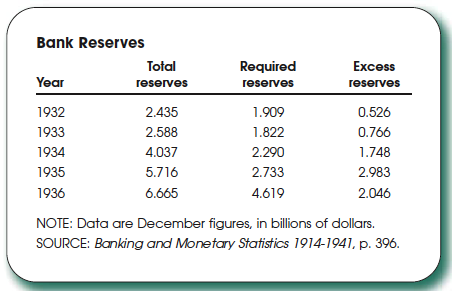

Few analysts recall, however, that this is the second, not the first, quantitative easing by U.S. monetary authorities. During 1932, with congressional support, the Fed purchased approximately $1 billion in Treasury securities (half, however, was offset by a decrease in Treasury bills discounted at the Reserve Banks). At the end of 1932, short-term market rates hovered at 50 basis points or less. Quantitative easing continued during 1933-36.”

Who knew?

>

Source:

The First U.S. Quantitative Easing: The 1930s

Richard G. Anderson

Monetary Trends, Federal Reserve Bank of St. Louis, July 2010

http://research.stlouisfed.org/publications/mt/20100701/mtpub.pdf

What's been said:

Discussions found on the web: