Contrarians beware: A long article on the rise of Gold as an investment asset class is on the front page of the NYT.

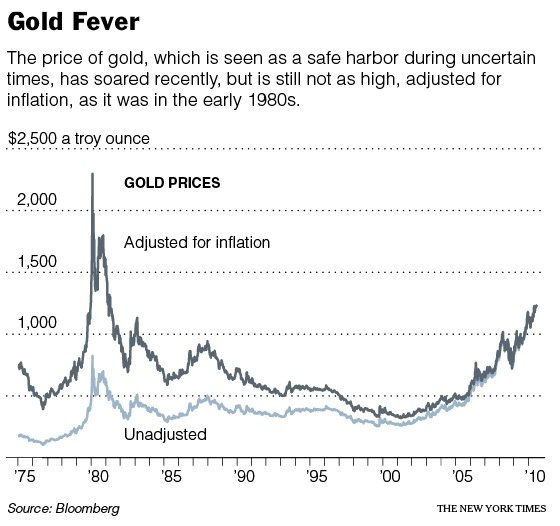

“Inflation, deflation, government borrowing or the plunging euro — you name it — the specter of these concerns has set off a dash to gold, driving the precious metal to new highs and illustrating how fears of economic turmoil have moved from the fringe to the mainstream.

And gold bugs, often dismissed as crackpots who hoard gold bars in the basement, are finally having their day…

The most visible new gold enthusiasts range from the Fox News commentator Glenn Beck on the right to the financier George Soros on the left, with even some sober-minded Wall Street types developing a case of gold fever. While their language may differ, they share a fundamental view that the age-old refuge of gold is relevant again, especially as other assets like stocks and national currencies show signs of weakness.”

The thinking behind such contrarian indicators (such as the magazine cover) is as follows: By the time any given investment trend reaches the critical mass required for a staid front page editor to become aware of it, it is very late in that cycle. Indeed, in order to be mroe than a merely quirky story, it has to have a broad enough appeal to be approved for the cover story.

I do not know whether a page one Sunday NYT article is the equivalent of a magazine cover. I will tag Paul McCrae Montgomery — inventor of the magazine cover indicator — and inquire.

Regardless, I still found it interesting that Gold is now a page 1 NYT story . . .

>

>

Source:

Uncertainty Restores Glitter to an Old Refuge, Gold

NELSON D. SCHWARTZ

NYT, June 12, 2010

http://www.nytimes.com/2010/06/13/business/13gold.html

What's been said:

Discussions found on the web: