Strategic walkaways gets the NYT treatment today. The data is fairly impressive:

-Foreclosure procedures have been initiated against 1.7 million households.

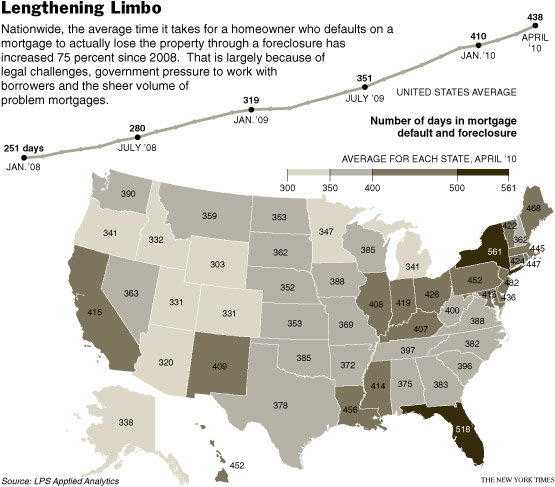

-Average borrower in foreclosure has been delinquent for 438 days before eviction;

-This is up from 251 days in January 2008.

-More than 650,000 households had not paid in 18 months.

-19 percent of those homes, the lender had not even begun to take action to repossess the property — double the rate a year earlier.

I find the rationalizations by the people who engage in the process rather interesting. The excuses — and they are simply excuses — consist of a long list of reasons that only hint at the simple truth of non-payment:

-The bank wouldn’t help

-“They’re all crooks.”

– “free rent”

– we have little to lose

– its self-preservation

A few people hint at it, but no one actually makes the rational claim as to the math of strategic (rather than emotional) default.

I would like to read one person make the honest statement:

“I’ve done the math, and it doesn’t make sense to pay the mortgage. I can rent the same house a block over for half of what I am paying. I am so far underwater that if I stay here, struggle, and make all the payments, in 10 years, I will merely be back to break even. Why bother?

Like all the big banks have all done, I’ve made the calculation that it is financially beneficial to default on the loan — so that is what I am doing. As Sonny was told in the Godfather, “This is business, not personal…”

>

I suspect this will be an ongoing story for the next 5 years . . .

>

>

Source:

Owners Stop Paying Mortgages, and Stop Fretting

DAVID STREITFELD

NYT, May 31, 2010

http://www.nytimes.com/2010/06/01/business/01nopay.html

What's been said:

Discussions found on the web: