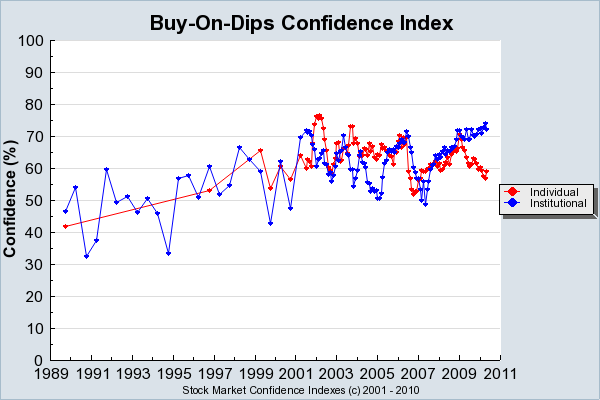

Since 1989, Yale Professor Robert Shiller has been compiling a “Buy-on-Dips Stock Market Confidence Index,” (now run by the Yale School of Management).

What is especially interesting is the divergence between individuals and institutions: From 2003-05, the Institutions were far less likely to buy on dips than the public. Since 2009, that has reversed, with the individual now far less interested in buying on the dip:

>

chart courtesy of e Yale School of Management

>

Yale:

“Confidence that the stock market will rise the day after a sharp fall showed an overall uptrend over the years from 1989 until shortly after it became clear that the 2000 peak in the market was a major turning point. Buy-On-Dips Confidence peaked at 71.93% as of July 2001 for institutional investors and at 76.65% as of March 2002 for individual investors. Between 2002 and 2006 Buy-On-Dips Confidence was often falling, but did not establish a clear trend.”

What's been said:

Discussions found on the web: