I have been adding some additional charts to my powerpoint for this afternoon.I am choosing amongst the areas I want to discuss, when an email came in regarding my presentation.

One of the conference participants made the following challenge to me:

“Can you support your position, in a fast, easy way, why the US housing boom was NOT caused by Fannie and Freddie, or the CRA? I understand all the factors you laid out in the book — but I would like to see more evidence to support your view.”

Well, its difficult to prove a negative — supporters of the “FNM/FRE/CRA caused it” should have to prove their case, as I did in Bailout Nation.

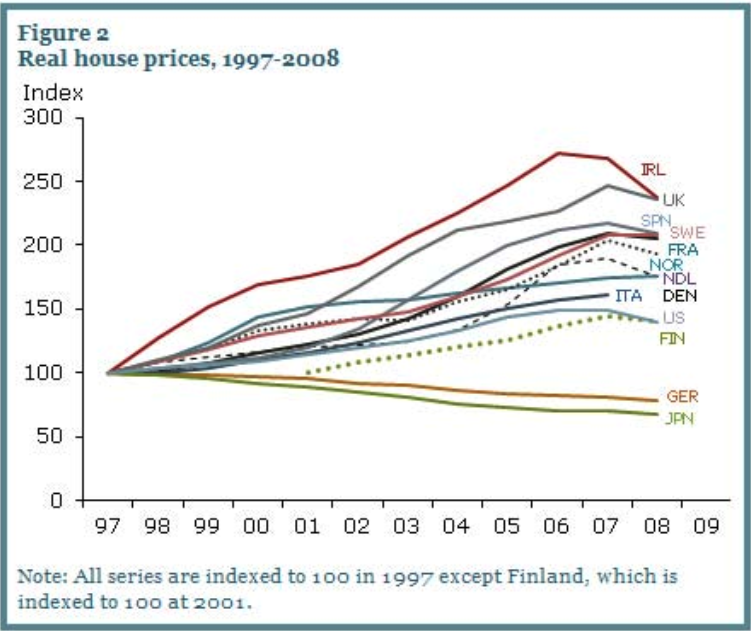

However, I have always found this chart to be quite compelling:

>

Chart via BIS by way of NewObservations.net

>

Pray tell what caused the same boom and bust in these other nations?

And how could Fannie/Freddie or the CRA be responsible — that only applies to the US — when you have the same, global, coordinated rise in prices? (And you can add Korea and New Zealand to the chart above).

For those of you who still believe the political talking point that it was FNM/FRE/CRA’s fault, the question remains: What caused these other nations to boom the same time the USA did?

And if you can’t answer that, then what hope do we have that you will offer up empirical evidence that Fannie/Freddie/CRA caused this in light of the above?

(This is what I mean by squishy thinking . . .)

>

UPDATE: July 21, 2010 10:35am

In a discussion with some of the more vocal “FNM/CRA caused the crisis” advocates, I made the following point that seems to have resonated with a few of them:

We must distinguish between US legislative policy — and that includes Fannie/Freddie and the CRA — with the monetary policy of the US Federal Reserve, and its impact around the world.

American legislative policies had some impact domestically, but the total result of the CRA was not global, not was the GSE impact Global. Hence, how could FNM/FRE/CRA cause a global housing boom & bust? Answer, it didn’t.

The US Federal Reserve’s monetary policy, on the other hand, did have a global impact. The US has the world’s reserve currency, the biggest economy and the most important central bank. When the Fed took rates down to 1%, it had an ginormous impact on everything priced in debt, dollars or leverage. That includes housing, around the world.

What's been said:

Discussions found on the web: