I’ll have more on the GS settlement tomorrow — but I keep getting emails from people insisting that since Goldman’s stock rallied, it is, therefore, a victory. I’ve always hated that analysis, but since so many of you keep bringing it up:

Pre-indictment, GS was north of $180. It closed Friday at $146. Its still some 20% below where it was before the SEC enforcement action began.

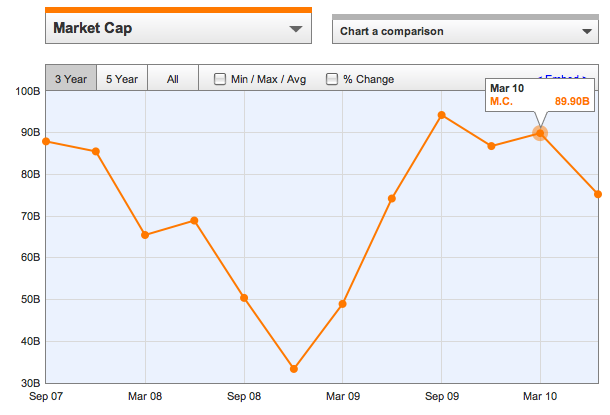

Goldman Sachs has lost $15 Billion of market capitalization. Isn’t that a significant part of the penalty? Or do we just ignore that?

>

via yCharts

What's been said:

Discussions found on the web: