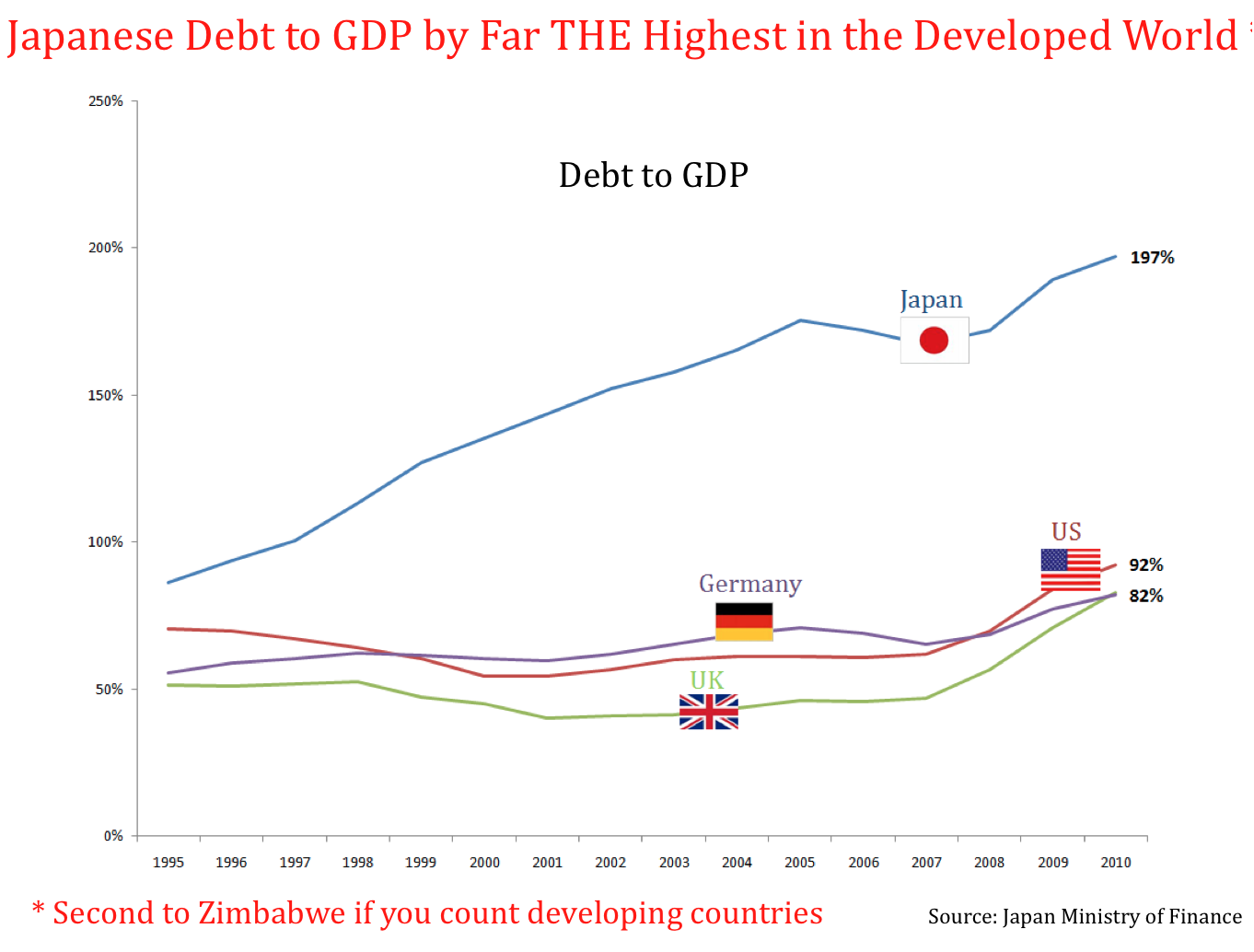

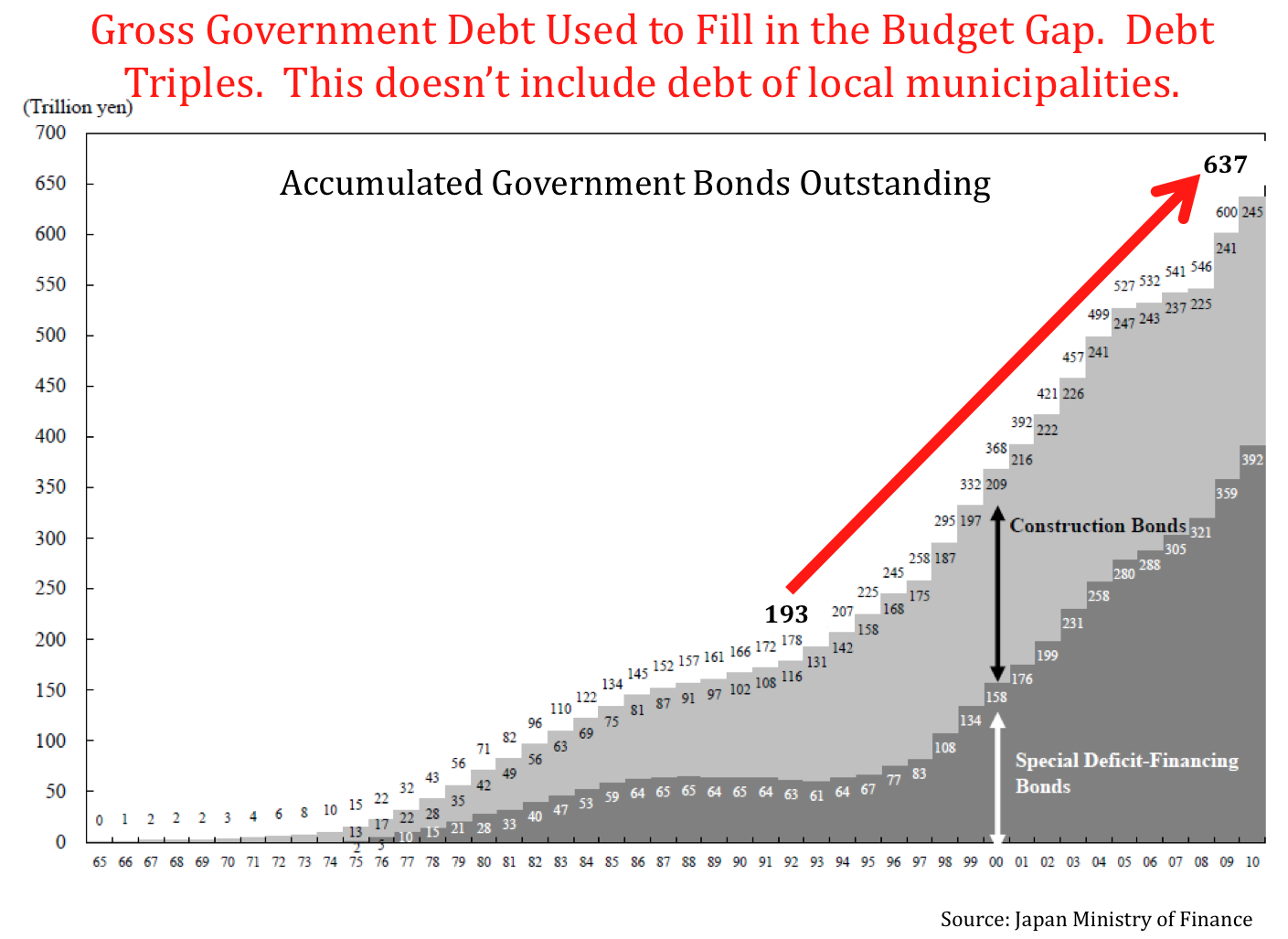

Vitaliy Katsenelson presented a very compelling argument that it is not Greece or Spain or Ireland or the USA that is the next major country to drop — its Japan.

These are two of his 25 slides, and they paint a bleak picture of Japan:

>

click for larger charts

Source: ContrarianEdge.com

What's been said:

Discussions found on the web: