Yet another economist who dines at the restaurant of the free lunch: David Greenlaw of the US Economics Team at Morgan introduces what he calls a “Slam Dunk Stimulus” of sorts:

“If it were possible to inject a significant amount of stimulus into the US household sector, and this stimulus had zero impact on the budget deficit, did not require an exit strategy, did not distort the markets, and took effect almost immediately, wouldn’t it seem like a slam dunk? Such an option actually exists in the form of a change to mortgage refinancing requirements.”

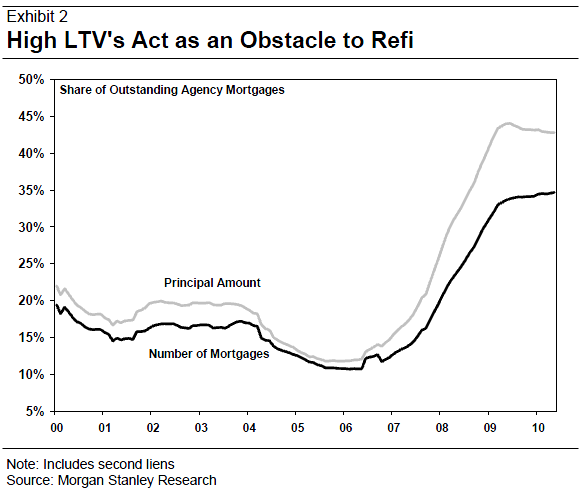

His proposal? Change the Loan-to-Value requirements of homeowners applying for a refinancing.

In other words: The solution to poor lending standards and ultra low rates is to reduce the lending standards further to take advantage of even lower rates.

WTF? If that sounds absurd, it probably is because it is.

The best rationale that Greenlaw musters for doing this is that Uncle Sam is already on the hook for the existing debt, so why the hell not do the refis: “The Federal government stands alone as the guarantor of the principal value of agency-backed mortgages.”

But that leads to such absurd conclusions as Greenlaw’s argument for a streamlined refi process for agency mortgages. In his final sentence, he states: “Quite simply, there is no need for a case-by-case credit analysis when the principal value of the mortgage is already backed by the government.”

I’m sure that will work out just fine . . .

>

>

Source:

Slam Dunk Stimulus

David Greenlaw

Morgan Stanley, July 27, 2010

US Economics

http://www.morganstanley.com/views/gef/team/index.html

What's been said:

Discussions found on the web: