There seems to be some misunderstanding as to my economic viewpoints beyond the usual recession/expansion, bull/bear, black/white dichotomies. Allow me to clarify:

>

The Recovery that we have seen has been uneven, with the Economy best described as “lumpy.” Pockets of growth not evenly distributed; lots of Fed and Treasury largesse driving activity.

Corporate (non-fin) balance sheets are cash rich and debt free, earnings are strong. The bright spots are Manufacturing and Industrials; On the other hand, Retail (except Autos) Housing, Finance, Materials are weak or weakening.

But overhangs of another leg down in Housing and weak job creation make it unlikely we will see any more 3-4% GDP over the next few Qs. And as we have noted for nearly a year now, record low hours worked means Employers can expand production without any new hires — they simply add hours to workers who gratefully will accept them.

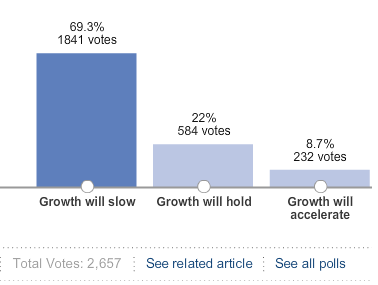

Based on the economic data, what we see now is for economic growth to slow — right now, we project the next few Qs of GDP to be in a 1.5 – 2.5% range. We do not rule out a double dip or a recession in 2012 — we simply do not have sufficient evidence to draw that conclusion.

Why? Recoveries typically surge once pent up consumer demand rushes into the early stages of a bounce. That surge eventually fades. As it does, a simple slow down and a recession look all but indistinguishable in the data for the first 6 to 12 months or longer. We are in that period now, and cannot differentiate between the two — yet.

So now, all we can say with any degree of confidence is that we see growth slowing, and await more data prior to making a recession call . . .

>

What's been said:

Discussions found on the web: