I have been covering the US Real Estate market for decades. I grew up with RE (mom was a RE broker and an investor). I have been a housing bear for about 5 years. I recognized the credit bubble and inevitable bust long before most other analysts/strategists/economists did.

I mention this just to inform readers that it is very rare that I come across any housing analysis that surprises me or adds to my understanding of the real estate landscape in a major way.

Which is why I am so pleased to introduce you to Dhaval Joshi, Chief Strategist at London based hedge fund RAB Capital (and former Societe Generale and J P Morgan Strategist).

Dhaval’s analysis looks a variety of housing data relative to household formation, housing stock, vacancy rates, and inventory is not the typical housing review. It is quite illuminating.

Enjoy:

~~~

Can the US economy really return to “business as usual” when it has 4 million houses surplus to requirement, when 1 out of 4 mortgages are in negative equity, and when by our calculation, it is burdened with $4 trillion of excess mortgage debt, equivalent to 30% of GDP?

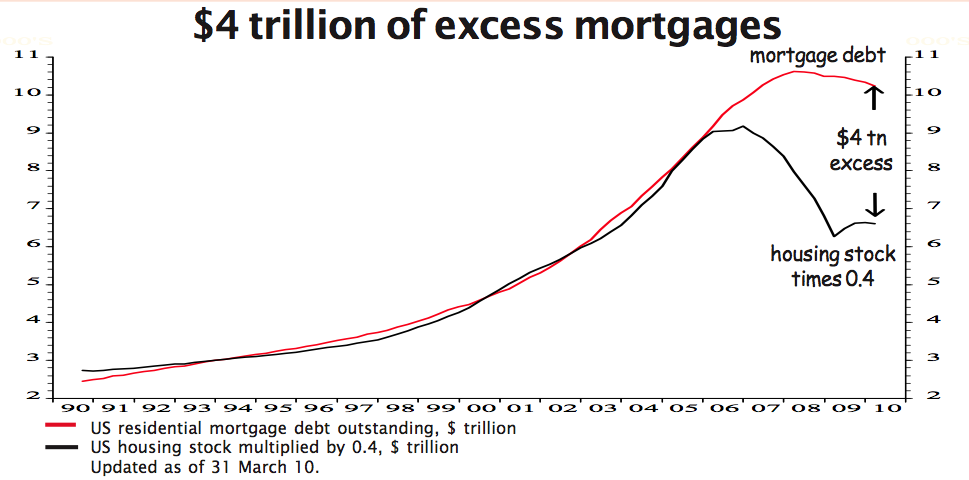

For many years, total mortgage debt consistently and reliably equalled 0.4 times the value of the US housing stock. Intuitively, this average of 0.4 makes perfect sense as every property usually has a mortgage ranging from 0 to 0.9 times its value. So in 1990, $6 trillion of housing collateral could support $2.5 trillion of mortgages, and by 2006, $23 trillion of housing collateral could support $10 trillion of mortgages. But since then, the US housing stock’s value has slumped to $16 trillion which means the amount of mortgage lending supportable by the collateral has plunged to $6 trillion. However, actual mortgage debt has remained at $10 trillion – $4 trillion too high.

The fact that mortgage debt has barely declined suggests that relatively few homeowners have defaulted on their mortgages or paid off debt yet. Instead, a quarter of all borrowers are sitting on negative equity. That’s just as well – because were mortgage debt to shrink by even half of $4 trillion, the US economy would slump.

Perhaps homeowners are patiently expecting house prices to rise again. But if so, they may be in for a long wait. Prices are likely to be weighed down by a massive oversupply of homes relative to underlying demographic demand. Whether you look at the houses to population ratio, the houses to household ratio or vacant houses ratio, the conclusion is the same – there is a 3% surplus of properties, equivalent to 4 million homes. And with household formation running at just 0.9 million while the US is still building 0.6 million new homes annually, only 0.3 million of the oversupply will be absorbed per year (see page 5).

Ultra low rates to stay

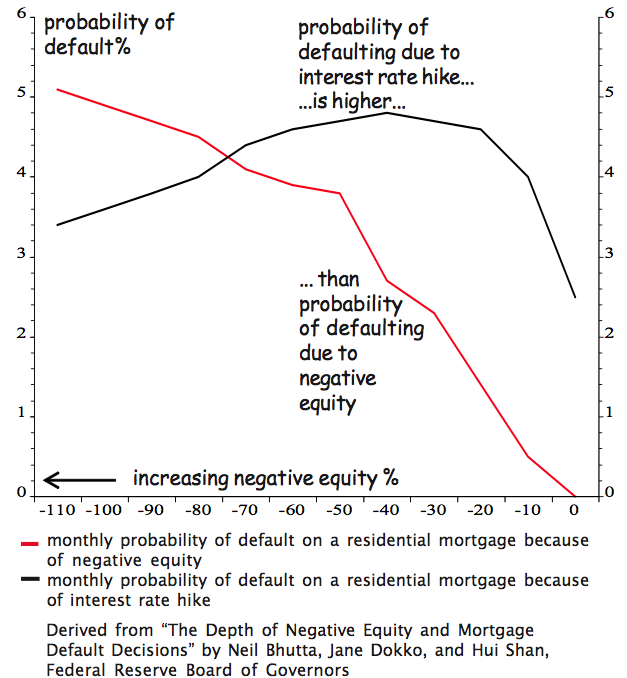

A recent study by the Federal Reserve (The Depth of Negative Equity and Mortgage Default Decisions by Bhutta, Dokko and Shan) investigated the question: at what point do underwater homeowners “strategically default” on their mortgages? Surprisingly, it found that the average borrower doesn’t walk away from his home until negative equity reaches a very high level, -62%. But the fascinating thing was that there was something that could trigger underwater borrowers to default much, much earlier – and that something was an interest rate rise.

With a quarter of US mortgages underwater, and likely to stay that way for some time, the Fed must follow its own research if it wants to prevent a cascade of defaults. Hence, expect US interest rates to stay ultra low for an ultra long time.

>

>

For many years, total mortgage debt consistently and reliably equalled 0.4 times the value of the US housing stock. Intuitively, this average of 0.4 makes perfect sense as every property usually has a mortgage ranging from 0 to 0.9 times its value. So in 1990, $6 trillion of housing collateral could support $2.5 trillion of mortgages, and by 2006, $23 trillion of housing collateral could support $10 trillion of mortgages. But since then, the US housing stock’s value has slumped to $16 trillion which means the amount of mortgage lending supportable by the collateral has plunged to $6 trillion. However, actual mortgage debt has remained at $10 trillion – $4 trillion too high.

>

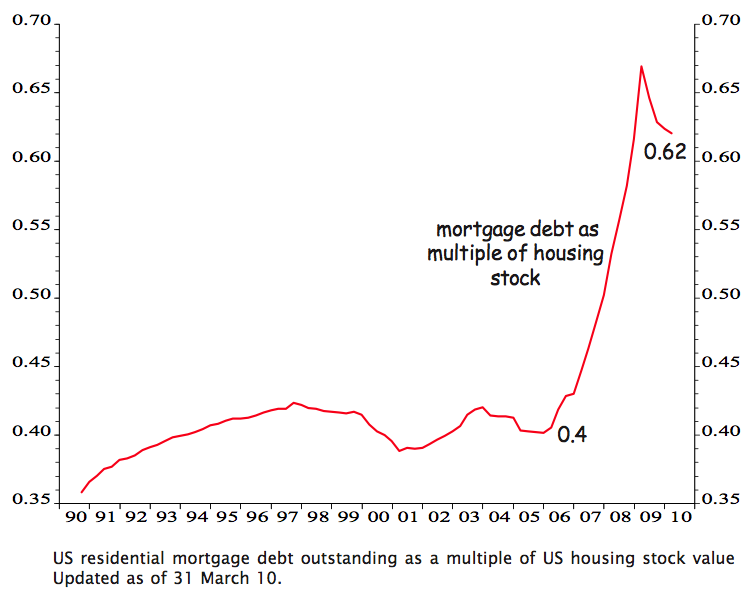

Loan to value ratio is 1.5 times too high

>

To put it another way, the loan to value ratio of total mortgages outstanding to housing stock value is currently 1.5 times too high.

>

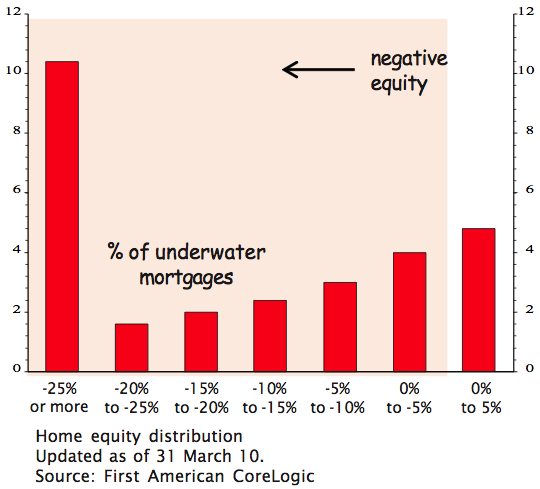

24% of US mortgages are underwater

>

The fact that mortgage debt has barely declined suggests that relatively few homeowners have defaulted on their mortgages or paid off debt yet. Instead, a quarter of all borrowers are sitting on negative equity.

>

Higher interest rates may trigger cascade of defaults

>

A recent study by the Federal Reserve investigated the central question: at what point do underwater homeowners “strategically default” on their mortgages? Surprisingly, it found that when the decision is based on negative equity alone, the average borrower doesn’t walk away from his home until it is very underwater (negative equity of 62%). But the fascinating thing was that there was something that could trigger underwater borrowers to default much, much earlier – and that something was an interest rate rise. In fact, higher interest rates were even more significant in triggering defaults than higher unemployment.

With a quarter of US mortgages underwater, the Fed must heed the advice of its own research if it wants to prevent a cascade of defaults and the consequent repercussions on the financial system and the economy. Hence, expect US interest rates to stay ultra low until millions of mortgages escape out of negative equity.

>

The US has built far too many houses

>

Perhaps homeowners suffering negative equity are patiently expecting house prices to rise again. But they may be in for a long wait. Prices are likely to be weighed down by a massive oversupply of homes relative to underlying demographic demand.

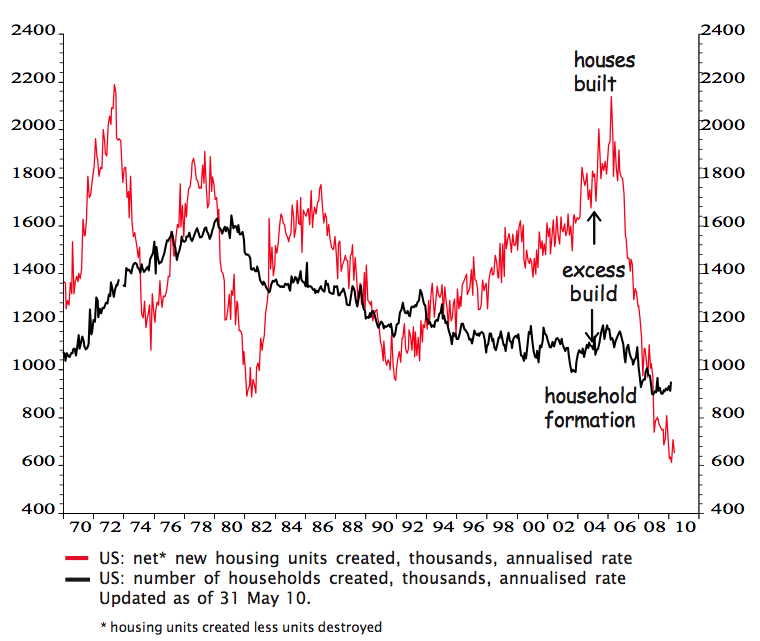

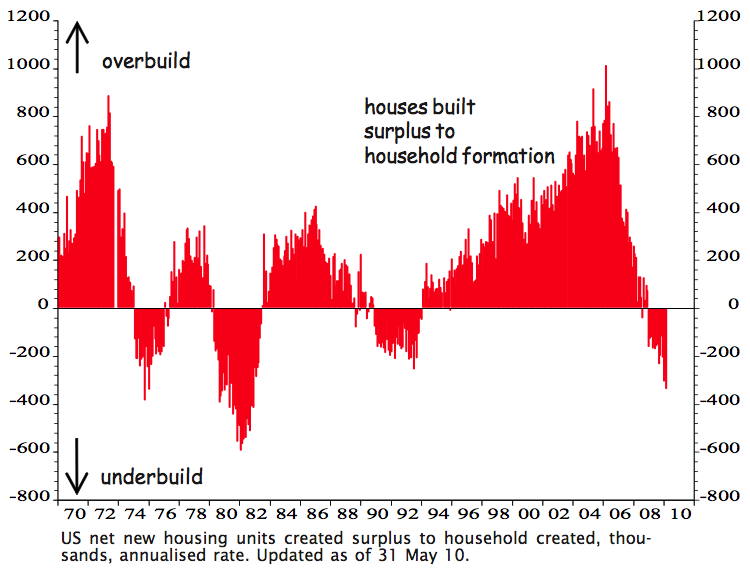

Between 2002 and 2006, US homebuilders went on a construction binge, building 12 million new homes while the number of households went up by just 7 million. The painful legacy is a massive oversupply of houses relative to the number of households.

>

The oversupply will take years to clear

>

With household formation running at just 0.9 million while the US is still building 0.6 million new homes annually, only 0.3 million of the oversupply will be absorbed per year. As there are currently 4 million too many homes, it may take years to mop up the huge oversupply of houses.

What's been said:

Discussions found on the web: