“Whoever is in command will determine the agency’s path. When you have a lot of power vested in an agency, everything depends on how effectively they carry out their rulemaking authority.”

-Kathleen Engel, a Suffolk University law professor who sits on the Federal Reserve’s Consumer Advisory Council (WSJ).

>

The real question is, who will be the first chairperson of this agency ?

>

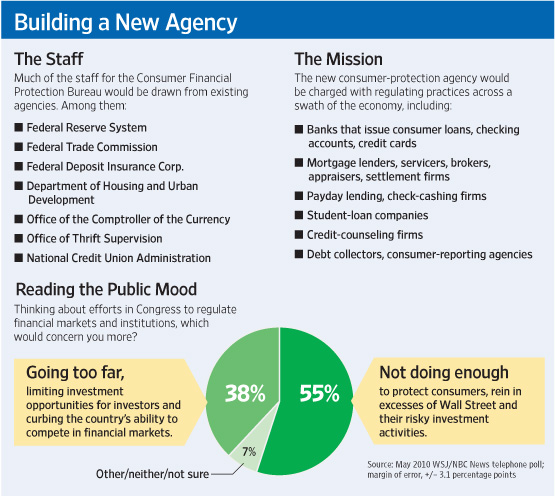

Source:

Consumer Agency’s Path Will Be Set by First Chief

SUDEEP REDDY

WSJ, JULY 6, 2010

http://online.wsj.com/article/SB10001424052748704699604575342992848011622.html

What's been said:

Discussions found on the web: