Yesterday, we looked at Long Term Market Cycles dating back to 1927;

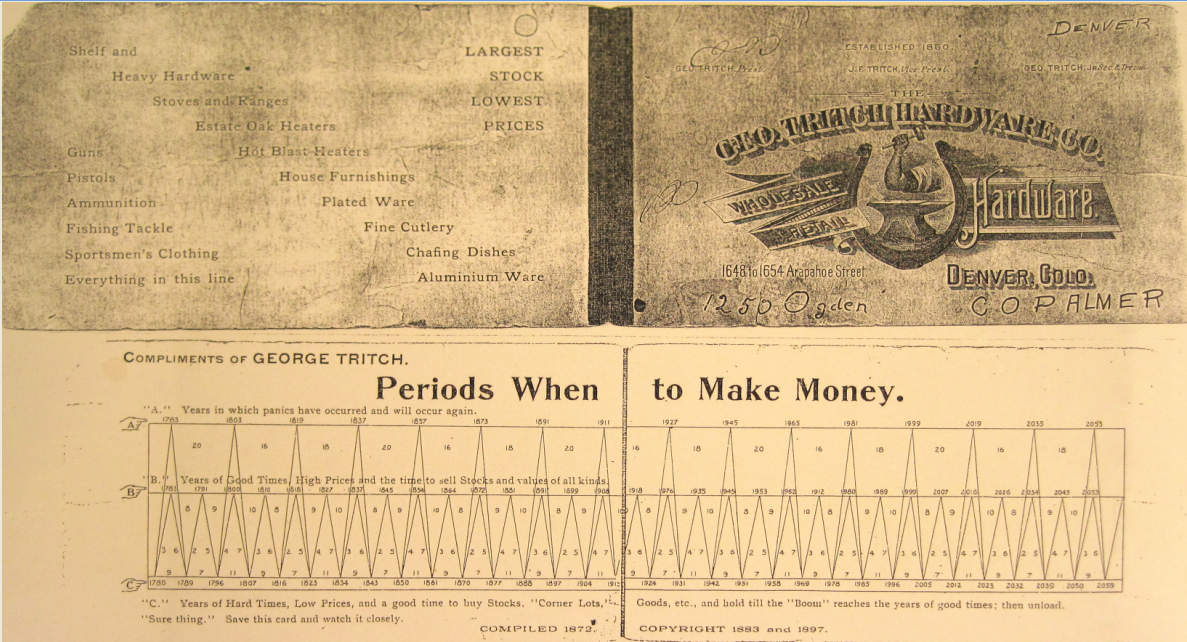

Today, lets have a look at periodicity dating back to 1763. The cycle the (unknown) author posis is a repeating 16/18/20 year

Across the top is the legend “Years in which panics have occurred and will occur again.” The past panic century of dates are 1911, 1927, 1945, 1965, 1981, 1999, 2019. Except for 1981, these were all pretty good years to sell (or short) stocks.

Fun stuff . . .

>

Hat tip Corey

What's been said:

Discussions found on the web: