‘Boy these companies look pretty good, earnings are OK, they have plenty of cash. What if there’s a double dip?’

‘I’m no macroeconomist, but . . .’

>

Here is an intriguing possibility, one that should make any investor holding 80% cash a tad nervous: The Buy/Sell/Hold crowd of analysts are excessively cautious:

“For the first time since at least 1997, fewer than 29 percent of ratings for stocks covered by brokerages worldwide are “buys,” according to 159,919 recommendations compiled by Bloomberg. Analysts are turning more pessimistic even as they push up estimates for profit growth among Standard & Poor’s 500 Index companies to 36 percent, the highest since 1988. . .

More than 54 percent of ratings for companies in the U.S., U.K., Japan and Brazil are “holds,” the highest level since Bloomberg began tracking the data in 1997. While the proportion of “sell” ratings in the U.S. has fallen to 5.1 percent, half the level of 2003, the total combined with “holds” reached a record 71 percent last month, the data show.”

As we have noted so many times previously, following the Wall Street crowd of analysts is rarely the way to make money.

Collectively, the analyst community has turned excessively bearish, versus their typical excessively bullish outlooks.

Why so many bearish stock calls from equity analysts? Fear of a double dip. Slowing growth. Concern that joblessness will weaken consumer spending. Uncertainty. Negativity on the economy. Credit issues. Lack of economic catalyst.

In other words, all of the general economic concerns trumpeted in the media each day — that these analysts have precisely zero expertise in identifying, anticipating and responding to. In fact, most stock analysts would have a hard time dissecting BLS employment data or understanding how GDP is calculated. Its outside of their roundhouse.

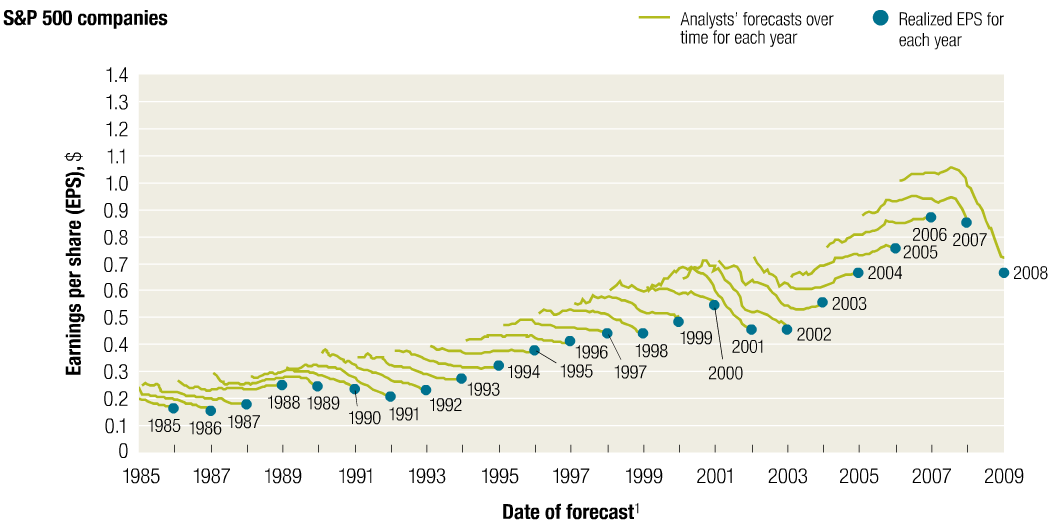

Historically, analysts typically “lag behind events in revising their forecasts to reflect new economic conditions.” A McKinsey study found that analyst forecast error is too bullish — except during downturns, when it is too bearish. Actual earnings from S&P 500 companies “only occasionally coincide with the analysts’ forecasts.”

As the chart below shows, most of the time the analyst community is too bullish by double — they expect earnings growth of 10 to 12%, compared with actual earnings growth of 6%.

However, the earnings recovery following a recession –like now — has analysts under-estimating earnings.

>

Bullish and Bearish at the Exact Wrong Times

>

Ultimately, excess pessimism amongst the analyst crowd may be a bullish contrary signal. It should make dedicated bears nervous . . .

>

Previously:

McKinsey: Equity Analysts Are Still Too Bullish (June 2nd, 2010)

Source:

Sell Signal on 36% Profit Gain Has Analysts in Denial

Rita Nazareth and Lynn Thomasson

Bloomberg, Aug. 30, 2010

http://noir.bloomberg.com/apps/news?pid=20601087&sid=atAHMd3u1AEo&

What's been said:

Discussions found on the web: