>

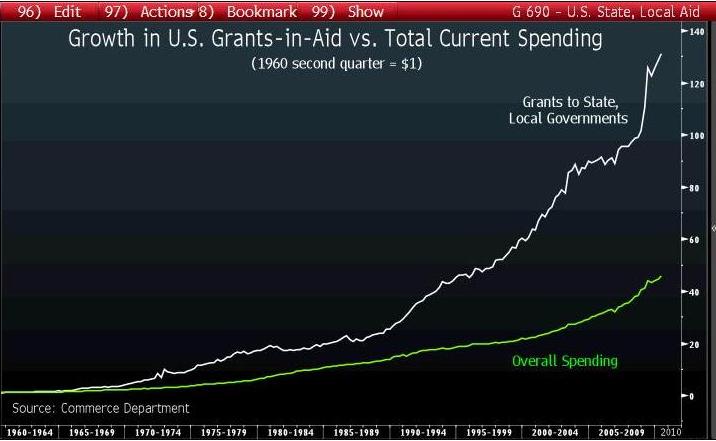

Bloomberg’s Chart of the Day shows the growth in federal payouts to state and local governments, also known as grants-in-aid, in the past half century:

They have increased almost three times as fast as overall spending during the period, according to data compiled by the Commerce Department. Funds were provided at a $525 billion annual rate in the second quarter, a 33 percent jump from two years ago. Most of the money went to pay health-care expenses under the Medicaid insurance program and to cover educational costs. . . .

The federal government provided $131.25 of state and local aid last quarter for every dollar spent 50 years ago. For total expenditures, the second-quarter figure was only $45.75, as the chart illustrates.”

That’s just great . . . Now I have another book to write.

>

Source:

Soaring Federal Aid Bails Out U.S. States, Cities: Chart of Day

David Wilson

Bloomberg, 2010-08-11 14:36:57.821 GMT

What's been said:

Discussions found on the web: