Everyone knew that Existing Home Sales were going to stink the joint up today — but I just had to laugh when I read the NAR commentary; The headline along was priceless: July Existing-Home Sales Fall as Expected but Prices Rise. Too bad they don’t cover other events: “Lincoln attends theater opening; leaves early with headache.”

They are the world’s most awesome/awful cheerleaders on the planet.

Bloomberg notes: “Foreclosures and short-sales are boosting the so-called shadow inventory, and competing with owners trying to sell properties. Home seizures increased almost 4 percent in July from the previous month, with 325,229 properties last month getting a notice of default, auction or bank repossession, RealtyTrac Inc. said Aug. 12.”

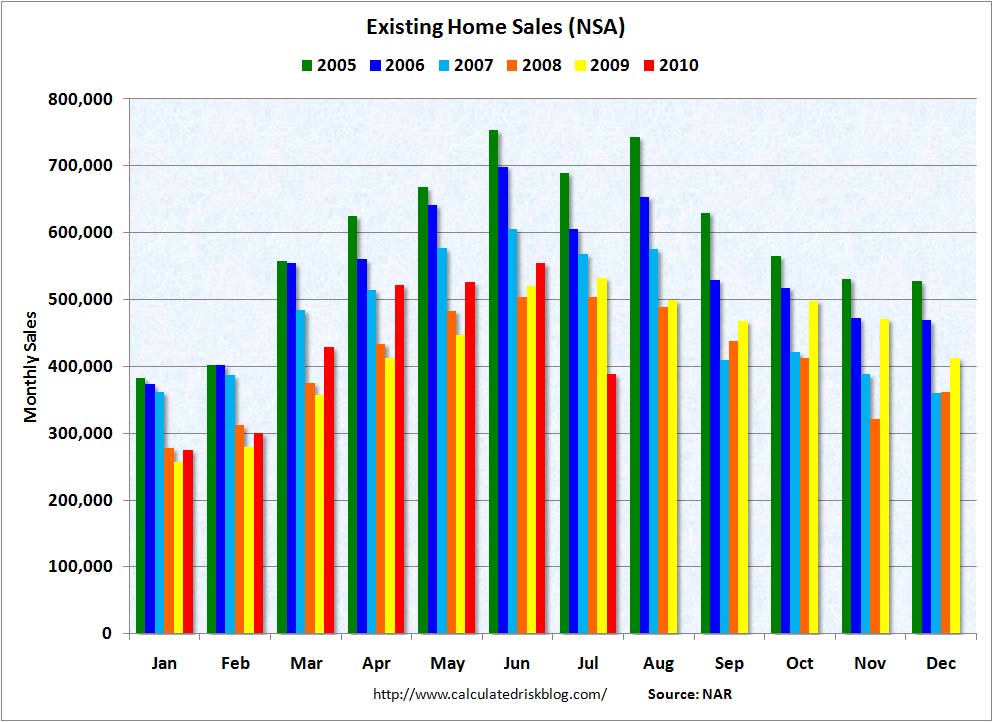

The housing data itself contains some worthwhile data points:

• National median existing-home price was $182,600 in July 2010 — 0.7% higher than June 2009.

• Distressed homes were 32% of sales, vs. 31% in July 2009.

• First-time buyers purchased 38% of all homes, down from 43% in June, according to an NAR survey. The decrease in the purchase of starter homes helps to explain the price rise.

• All-cash sales were at 30%, up from 24% in June.

• Total housing inventory rose 2.5% to 3.98 million homes — an 12.5 month supply at the current sales pace, up from 8.9 months in May.

• Unsold inventory remains 12.9% below the record of 4.58 million in July 2008.

• Existing-home sales in the Northeast dropped 29.5% (30.3% down from July 2009): They were down 35% in the Midwest (off 33.3% from July 2009); They fell 22.6% in the South (19.8% lower than July 2009); and were down 25% in the West (off 23% from July 2009).

Note that July home sales still have some tax credit closings, so the data is not perfect.

>

click for ginormous graphic>

>

UPDATE: An error was made in transcribing some of the data from the NAR release; it has been corrected; the bullet points above reflect the updated data. Our apologies for the error.

>

Source:

Existing-Home Sales Slow in June but Remain Above Year-Ago Levels

National Association of Realtors, July 22, 2010

http://www.realtor.org/press_room/news_releases/2010/07/ehs_june

July Existing-Home Sales Fall as Expected but Prices Rise

National Association of Realtors, August 24, 2010

http://www.realtor.org/press_room/news_releases/2010/08/ehs_fall

What's been said:

Discussions found on the web: