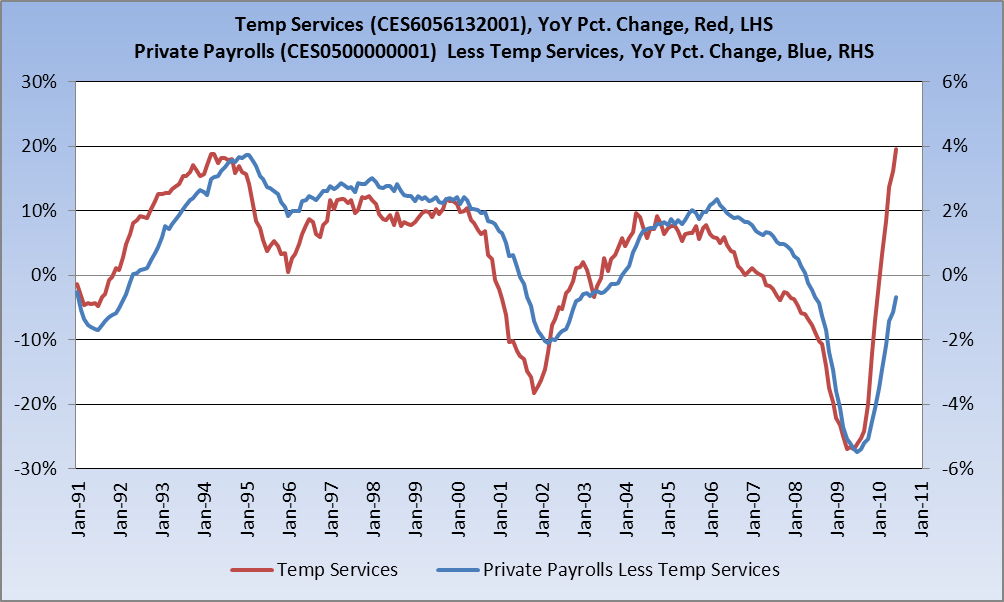

You may recall that last month we picked up on a troubling signpost in the divergence between temporary hiring and private sector payrolls (less temps). In that post, I produced the following chart (below is from last month’s post, not updated with most current data):

I wrote:

But here’s the thing: Temp jobs are now up 19.6% year over year, a record for the series going back to 1990 (when BLS began tracking it). Private sector jobs less temp jobs are still down 0.7% year over year. Historically — and I’ll admit going back only to 1990 isn’t a particularly robust data set — when temp jobs are up over 10% year over year, private sector jobs (less temp jobs) are running in the range, on average, of +2.4% YoY, not -0.7%. In the 20 year history of the series, never has the year over year gain been 10% or more while the private sector (ex-temp) has been negative.

Again, we may have a problem on our hands as the growth in temporary jobs has run away from the growth of the private sector. Now, temp jobs could continue setting YoY records — I wouldn’t rule that out at all. However, we do need to see the private sector start to kick into gear and play some serious catch up. As I’ve groused many times before, we’re starting to see late-cycle prints in some series, and we’ve barely even begun to put people to work. Very troublesome, to say the least.

Well, Temp Services declined by 5.6k this month in Friday’s NFP report, and the WSJ was all over it:

Does the Drop in Temps Signal Trouble Ahead?

Temporary-help employment is generally considered a leading indicator for the overall labor market. So July’s decline in temp payrolls is a worrisome indicator for the coming months.

Again, many metrics now have a distinct late-cycle feel to them. Temp Services, for example, is startinig to run into some difficult comps, as are many other data points (including, eventually, corporate earnings, which are still coming off a fairly low bar). Come on, WSJ, read TBP and you coulda had this story last month.

What's been said:

Discussions found on the web: