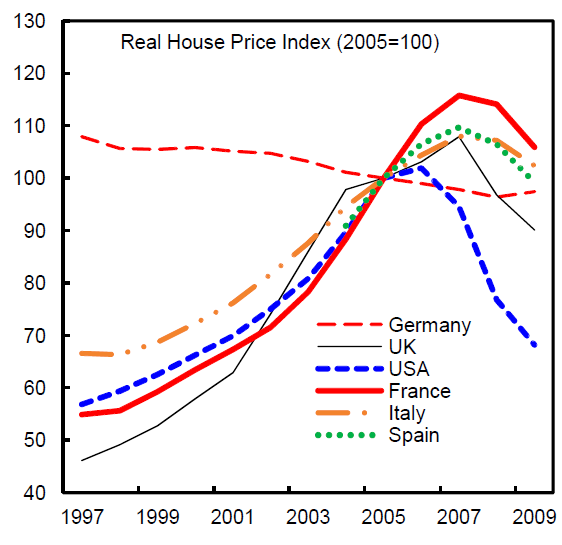

Any explanation of the Housing boom and bust should be able to explain why it was global in nature. Hence, our earlier focus on issues such as interest rates, lending standards, securitization, scramble for yield, etc.

As Ambrose Evans-Pritchard writes in the Telegraph:

“Once and for all, let us nail the lie that the global credit crisis was basically a US sub-prime property bubble that went wrong, and that Europe was merely an innocent bystander hit by shrapnel.

This is the property bubble chart on Page 12 of the IMF’s latest report (Article IV) on France. If you read the whole report – (click “Staff Report” here) – note the horrendous decline in French export share. But that is another story. As you can see, France had the most extreme price rises from 1997 to 2009, followed by Spain and Italy some way below.

The Anglo-Saxons were more moderate. The US bubble was tame by comparison (measured by price: inventory overhang is another matter) and has largely corrected. This the American way, a short sharp purge. The Club Med bubbles have not corrected, by a long shot.”

>

House Prices Declining from Peaks Around the World

chart courtesy of IMF

>

Sources:

IMF Executive Board Concludes 2010 Article IV Consultation with France

International Monetary Fund, July 30, 2010

http://www.imf.org/external/np/sec/pn/2010/pn10103.htm

PDF

Reckless Europe beats reckless America at property bubbles

Ambrose Evans-Pritchard

Telegraph, August 3rd, 2010

http://blogs.telegraph.co.uk/finance/ambroseevans-pritchard/100007092/reckless-europe-beats-reckless-america-at-property-bubbles/

What's been said:

Discussions found on the web: