I have to point to two very odd MSM pieces — one on the front page of the NYT today, the other in the OpEd page of the WSJ in March 2009. Each shows a misunderstanding of Housing that I think is significant.

Lets start with today’s NYT. Front page, top left corner, second paragraph:

“Mr. Cuomo was housing secretary at a critical moment for the nation, just as its subprime mortgage fever was beginning to spike. It was during his tenure that the banking industry began to embrace predatory loans, and these creations led to a housing bubble that badly damaged America’s banks and nearly toppled its financial system.” (emphasis added)

That is a big WTF moment for a front page article of a major paper. And it is, of course, wildly incorrect. Cuomo was at HUD until Clinton left office (1997-January 2001); His tenure at HUD ended before the rate cutting at the Fed began in 2001. The sub-prime fever did not begin until years later, and did not peak until years after that. (Note that I don’t care at all about Cuomo — it is the housing timeline I want to see portrayed accurately).

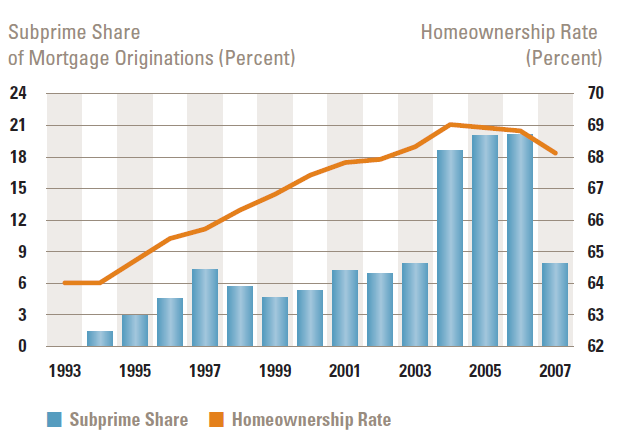

The St. Louis fed noted in a research piece (The Evolution of the Subprime Mortgage Market) that the big spike in Sub-Prime loan origination began from 2002 to 2003, when “LoanPerformance data show a 62 percent increase and the Inside Mortgage Finance data show a 56 percent increase in originations.”

As the chart below shows, subprime blew up in 2004-06; the Times got the time-line completely wrong in a front page story.

>

Source: Joint Center for Housing Studies of Harvard University STATE OF THE NATION’S HOUSING 2008

>

The Times partly acquits itself with following paragraph:

“The record shows that the mortgages bought by Fannie and Freddie during Mr. Cuomo’s tenure had low default rates. More broadly, if Mr. Cuomo was less prescient and gutsy than he now claims, no one seriously argues he deserves some outsize share of the blame for the subsequent collapse. Far more powerful actors, including the finance industry, its various regulators, two presidents and Congress, helped create the environment and wrote the policies that caused it.” (emphasis added)

~~~

Next up: My Caribbean cruising buddy Gary Shilling, in the WSJ OpEd pages last year. (hat tip).

I am in agreement with Gary about an Immigration solution to Housing — (I have mentioned this in the past) But I have to take issue with his statement “the 1996-2005 housing bubble.”

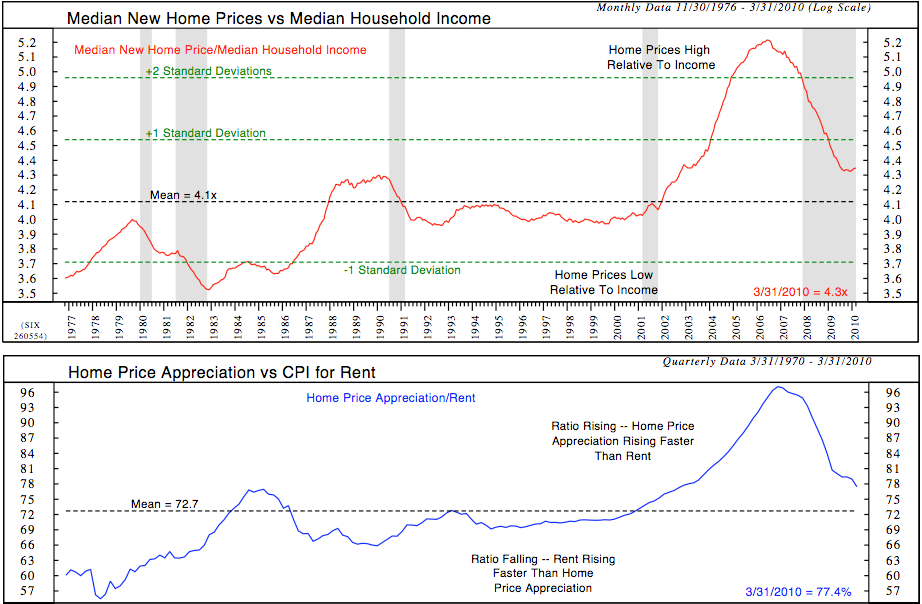

I have been arguing since 2005 that we had a credit bubble, not a housing bubble. But even if you ignore the credit argument, and think of it as a pure Housing bubble, how does one get 1996? Home prices This exploded in 2003-04, and peaked in 2006-07.

See the Ned Davis Charts:

>

Sources:

As HUD Chief, Cuomo Earns a Mixed Score

DAVID M. HALBFINGER and MICHAEL POWELL

NYT, August 23, 2010

http://www.nytimes.com/2010/08/24/nyregion/24hud.html

Immigrants Can Help Fix the Housing Bubble

RICHARD S. LEFRAK and A. GARY SHILLING

WSJ, MARCH 17, 2009

http://online.wsj.com/article/NA_WSJ_PUB:SB123725421857750565.html

What's been said:

Discussions found on the web: