A report on the Nanex site seems to be going around — its worth mentioning.

Nanex, as several readers pointed out (see this), wrote an Analysis of the “Flash Crash” that blamed the May 6th 1,000 point Dow swoon on High Frequency Trading (HFT).

Given that their business is “supplying a real-time data feed comprising trade and quote data for all US equity, option, and futures exchanges” along with the creation of “numerous tools to help us sift through the enormous dataset,” their perspective has the validity, tools, and skills welook for when confronted with unusual trading patterns. It is well worth considering.

I cannot tell if it is, as alleged, “Algorithmic Terrorism” — but it sure is interesting looking:

>

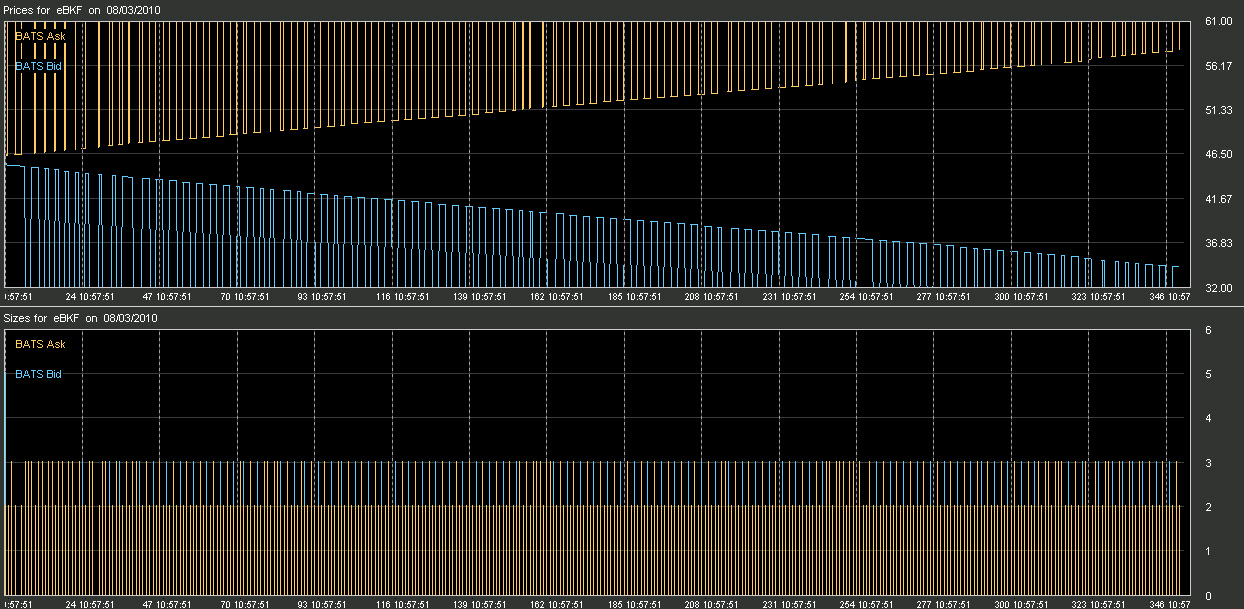

08-03-10

BATS “Scissors”. Classic example of BATS quoting, intermitting a stub quote, quoting 1 penny above or below the last valid quote (up on the ask side, down on the bid side) then another stub quote, etc.

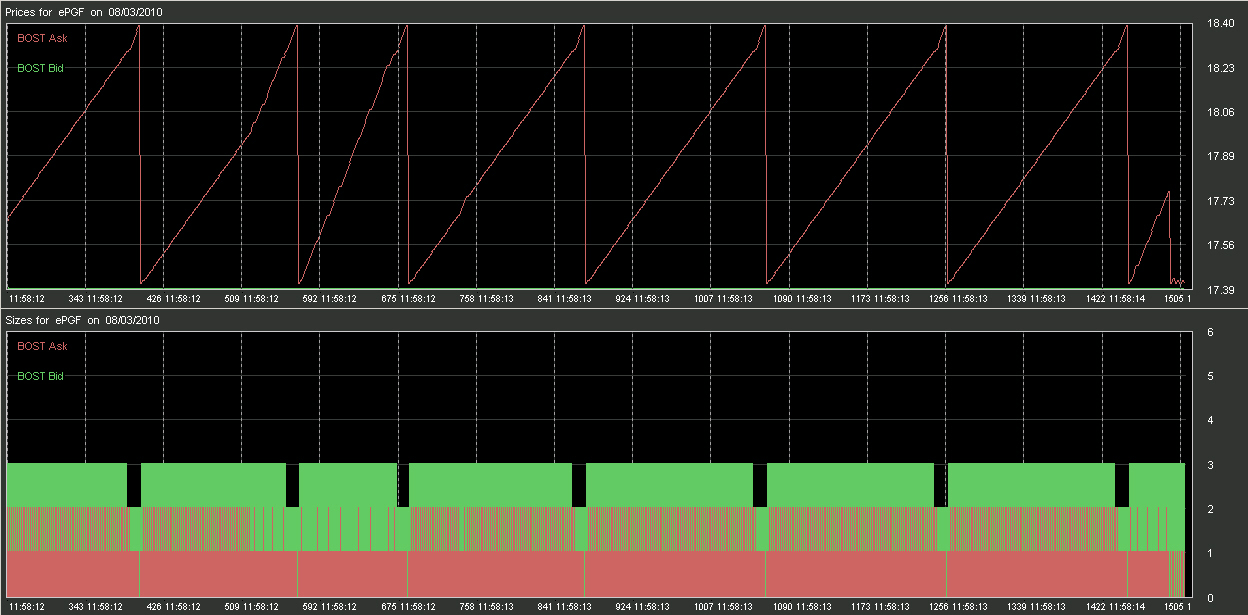

08-03-10

“Boston Shuffle”. 1250 quotes in 2 seconds, cycling the ask price up 1 penny a quote for a 1.0 rise, then back down again in a single quote (and drop the bid size at that time for a few cycles).

Source: Nanex

What's been said:

Discussions found on the web: