The Department of Numbers has an interesting set of charts looking at Tax Revenue as a Fraction of GDP.

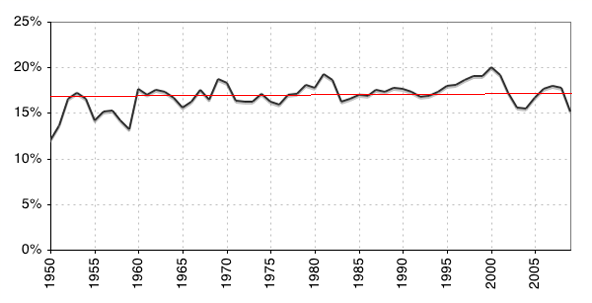

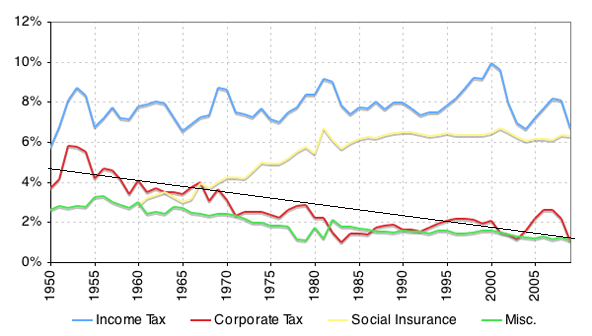

You should go to Dept of #s to read the commentary explaining the hows and whys, but meanwhile, see these charts — I added a (ballpark) mean to both series:

>

Total US Tax Revenue as a Percentage of GDP (~16.5%)

US Tax Revenue as a Fraction of GDP by Component

(Corporate Tax falls from >4% to ~2%)

What's been said:

Discussions found on the web: