The 56 year cycle mentioned yesterday (“Periods When to Make Money” (© 1883) was picked up by FT Alphaville; we hear it caused some “consternation” in certain circles where the marinating of ice cubes takes place.

The 56 year cycle mentioned yesterday (“Periods When to Make Money” (© 1883) was picked up by FT Alphaville; we hear it caused some “consternation” in certain circles where the marinating of ice cubes takes place.

I find these approaches quite fascinating, if for no other reason than I consider myself a student of market history. (Whether it is an actionable thesis is an entirely different question). For those of you who are also interested in such things, let’s explore this periodicity, better known as the Benner Cycle.

Samuel Benner was a prosperous farmer who was wiped out financially by the 1873 panic. When he try to discern the causes of fluctuations in markets, he came across a large degree of cyclicality.

Benner eventually published his findings in a book in 1875 — BENNERS PROPHECIES: FUTURE UPS AND DOWNS IN PRICEs — making business and commodity price forecasts for 1876 -1904. Many (but not all) of these forecasts were fairly accurate.

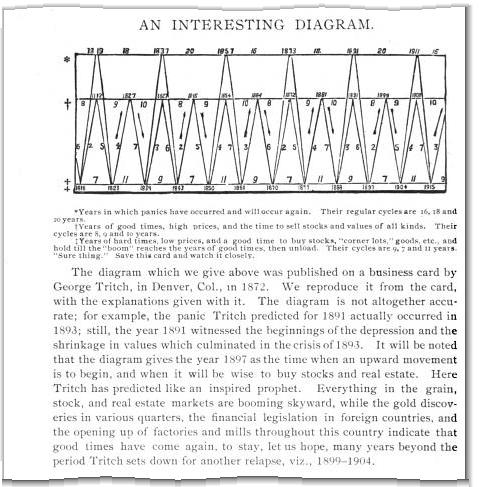

The Benner Cycle includes:

-an 11 year cycle in corn and pig prices with peaks alternating every 5 and 6 years.

-cotton prices which moved in a cycle with peaks every 11 years.

-a 27 year cycle in pig iron prices with lows every 11, 9, 7 years and peaks in the order 8, 9, 10 years.

It makes some degree of intuitive sense that a farmer would recognize longer term cycles. Their entire year is based on the annual sowing/growing/reaping cycle; The 11 year solar cycle would certainly impact their crop yields, revenue, etc. So looking at how the variants of crop yield and prices impacts the overall economy and markets makes lots of sense.

There are two caveats to all of these cyclical variants — Gann, Elliot Wave, Fibonnacci, Benner. First, consider there is insufficient data — we really need 500 years of market history to have a better data set to draw conclusions. Second, the unfortunate tendency to form fit after the fact (I see people doing this with Fibs especially). Mnay of the peaks and valleys are off by a year or two, but it looks close. Some of it might be explained by randomness.

Regardless, I think it is worth thinking about as a general long term framework — and a reminder that the so-called 100 year floods comes along much more frequently than the name implies . . .

Via Google Books

>

For those who wish to explore this further, you should check out David McMinn’s THE BENNER CYCLE, FIBONACCI NUMBERS& THE NUMBER 56.

I am not a huge Prechter fan, but I found his book Prechter’s Perspectives very intriguing — it covers the long term political-socio-economic cycles of recession, war, recovery, expansion, bubble, etc. It is intellectually stimulating, but not exactly actionable . . .

What's been said:

Discussions found on the web: