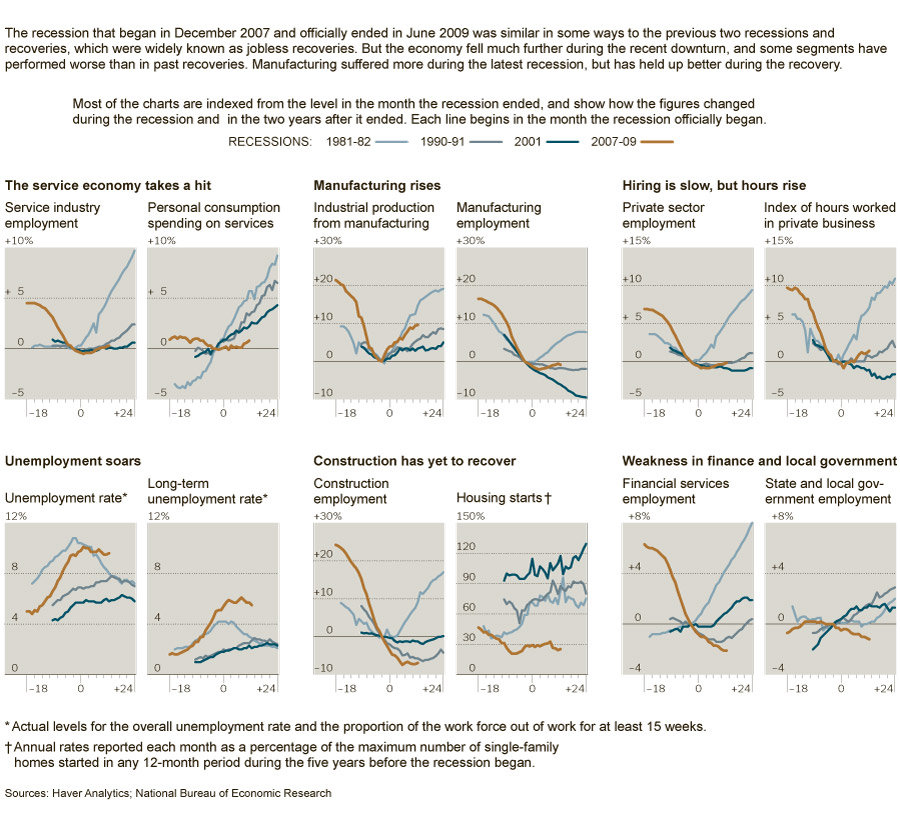

Floyd Norris takes a closer look at the current post-recession recovery, compared to prior recoveries. The overall trend appears to be slower snapbacks (1990-91 and 2001), jobless recoveries (2001, 08-09).

The chart above shows the economic data where this recovery is typical and very atypical.

In some areas, the data is typical of 1990-91 and 2001 recessions, but worse than the 81-82 recovery: Service employment, Private sector hiring, hours worked. Manufacturing Jobs are better than 2001, and 1991, worse than ’82. Industrial production is better than 91/01, and almost as good as 82.

Where this recovery is much much worse than typical: Unemployment rates, Long Term unemployed, Construction employment, housing starts, financial service employment (duh), state and local government hiring.

>

Source:

Recessions and Recoveries Are Not All the Same

FLOYD NORRIS

NYT, September 24, 2010

http://www.nytimes.com/2010/09/25/business/economy/25charts.html

What's been said:

Discussions found on the web: