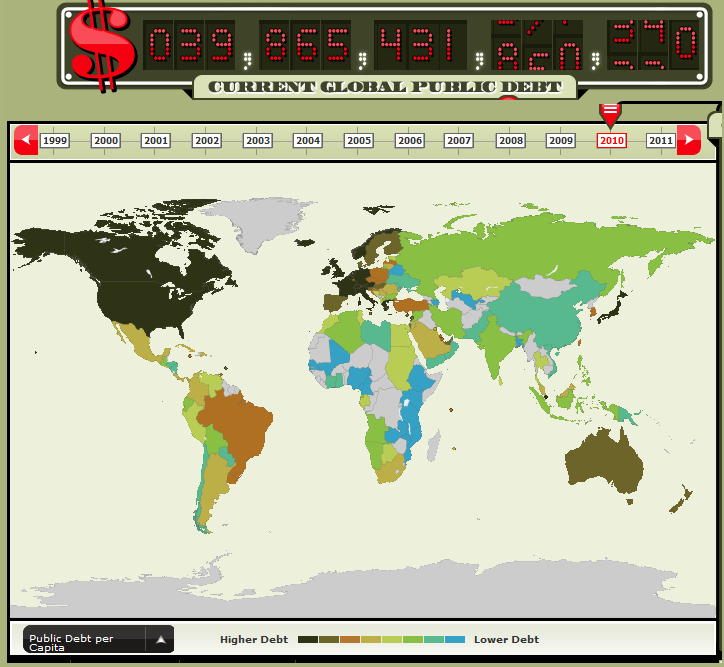

Global Public Debt Clock, from The Economist:

>

click for interactive graphic

>

Track and forecast public debt in countries around the world, is now live on the Buttonwood Gathering website. The Global Public Debt Clock provides a graphic perspective on an important and much discussed global economic issue.

Global public debt for 2010 is close to $40 trillion and is predicted to rise to over $42 trillion in 2011. In 2009, global debt was just under $37 trillion:

-US public debt is currently at $8.5 trillion, 58 % of GDP. It is predicted to rise to $9.5 trillion in 2011, which will be 63.1% of GDP.

-Japan’s public debt is currently $10.6 trillion, 196.1% of its GDP

-Greece’s public debt is currently $374.6 billion, 127.8% of its GDP.

-Chinese public debt is approximately $949 billion, 17.3% of its GDP.

Now if The Economist would make this an embeddable widget, they would be on to something . . .

What's been said:

Discussions found on the web: