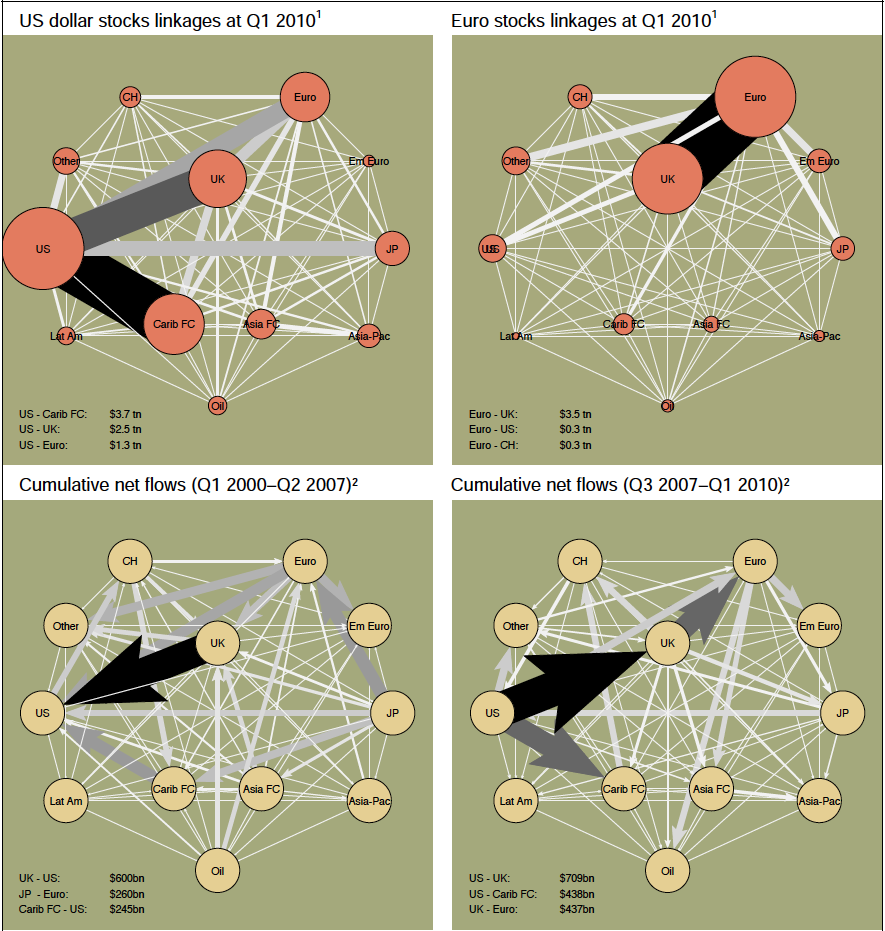

Fascinating chart in the BIS Quarterly Review that helps to explain how any banking crisis can go viral, infecting the entire globe:

>

click for bigger graphic

Chart courtesy of BIS

Excerpt:

“This article outlines a broad framework for assessing system-wide funding risks and analysing banks’ role in the transmission of shocks across countries. It highlights the need to complement essential data on banks’ consolidated balance sheets with information that provides a geographically disaggregated picture of those balance sheets. It then discusses how far the BIS international banking statistics, which have several though not all of the desired statistical properties, can go in providing measures of system-wide funding risk.”

>

Source:

Bank structure, funding risk and the transmission of shocks across countries: concepts and measurement

Ingo Fender, Patrick McGuire

BIS Quarterly Review, September 2010

http://www.bis.org/publ/qtrpdf/r_qt1009.htm

What's been said:

Discussions found on the web: