Not so much, according to Jesse’s Café Américain:

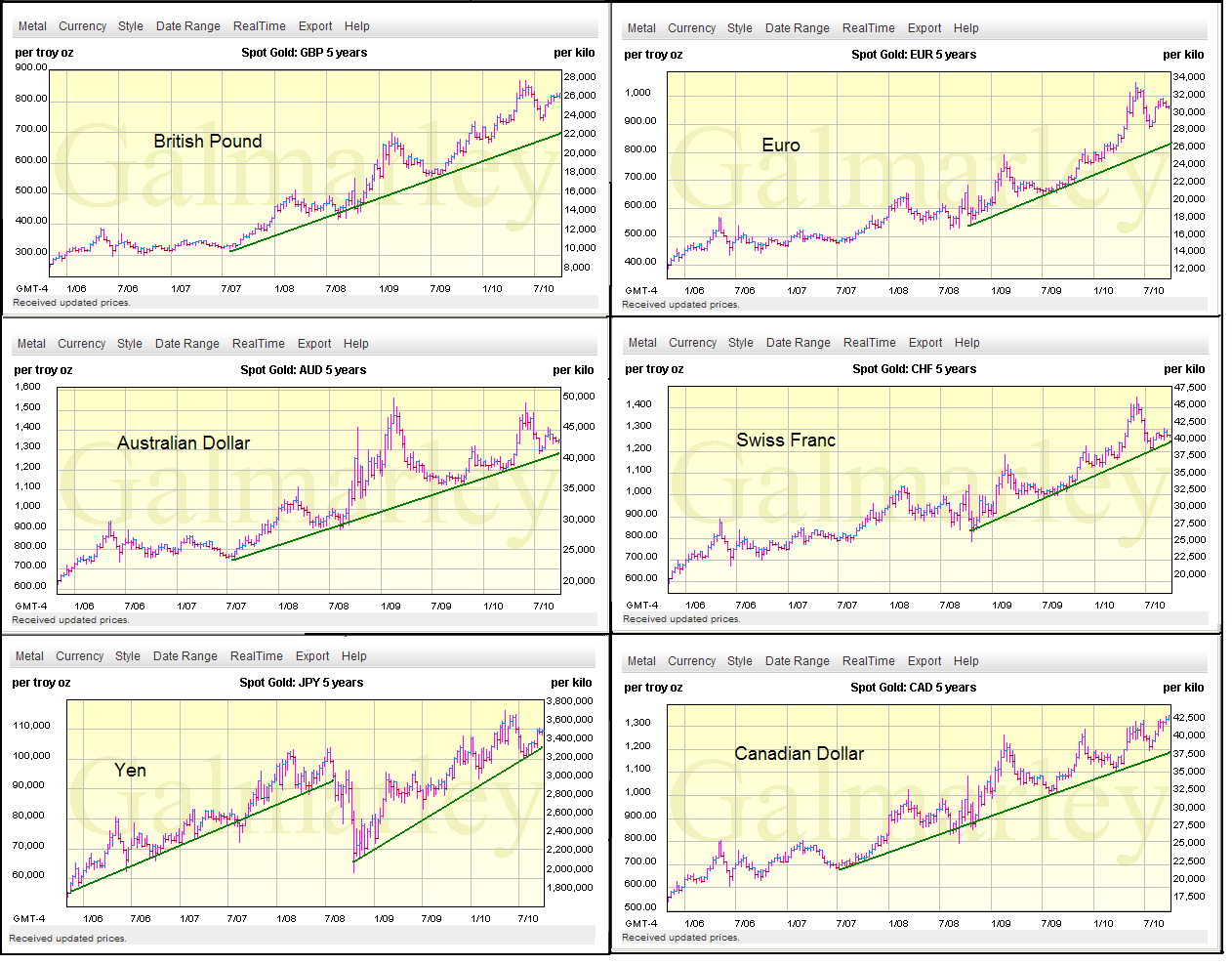

“But the US dollar is not alone, not the only fiat currency in a bit of a crisis. Since one picture is worth a thousand words, here is the price of gold over the last five years in six of the world’s major currencies of the developed nations. Granted, the price of gold may be different in select currencies. One has to make their own investment decisions to suit their own particular circumstances.”

>

What's been said:

Discussions found on the web: