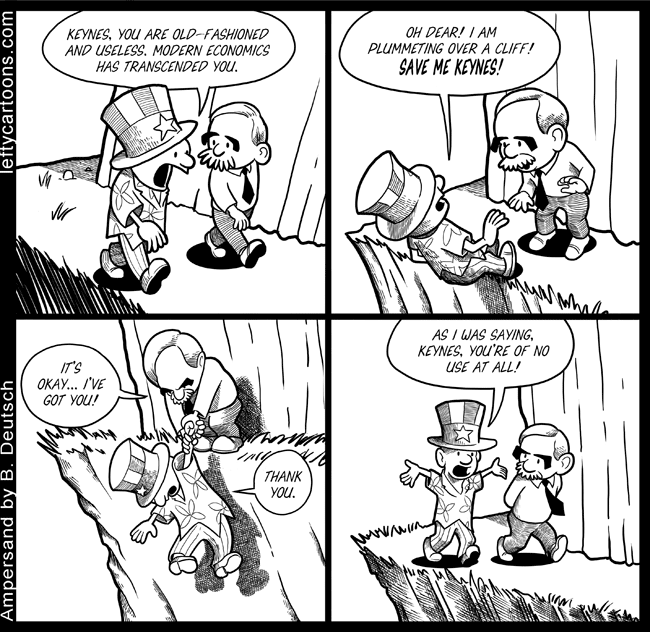

Apropos of our earlier Volcker discussion, consider this classic an indictment of the Business Schools Tall Paul referenced:

>

Via Amptoons

Hat tip Jay H

Apropos of our earlier Volcker discussion, consider this classic an indictment of the Business Schools Tall Paul referenced:

>

Via Amptoons

Hat tip Jay H

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: