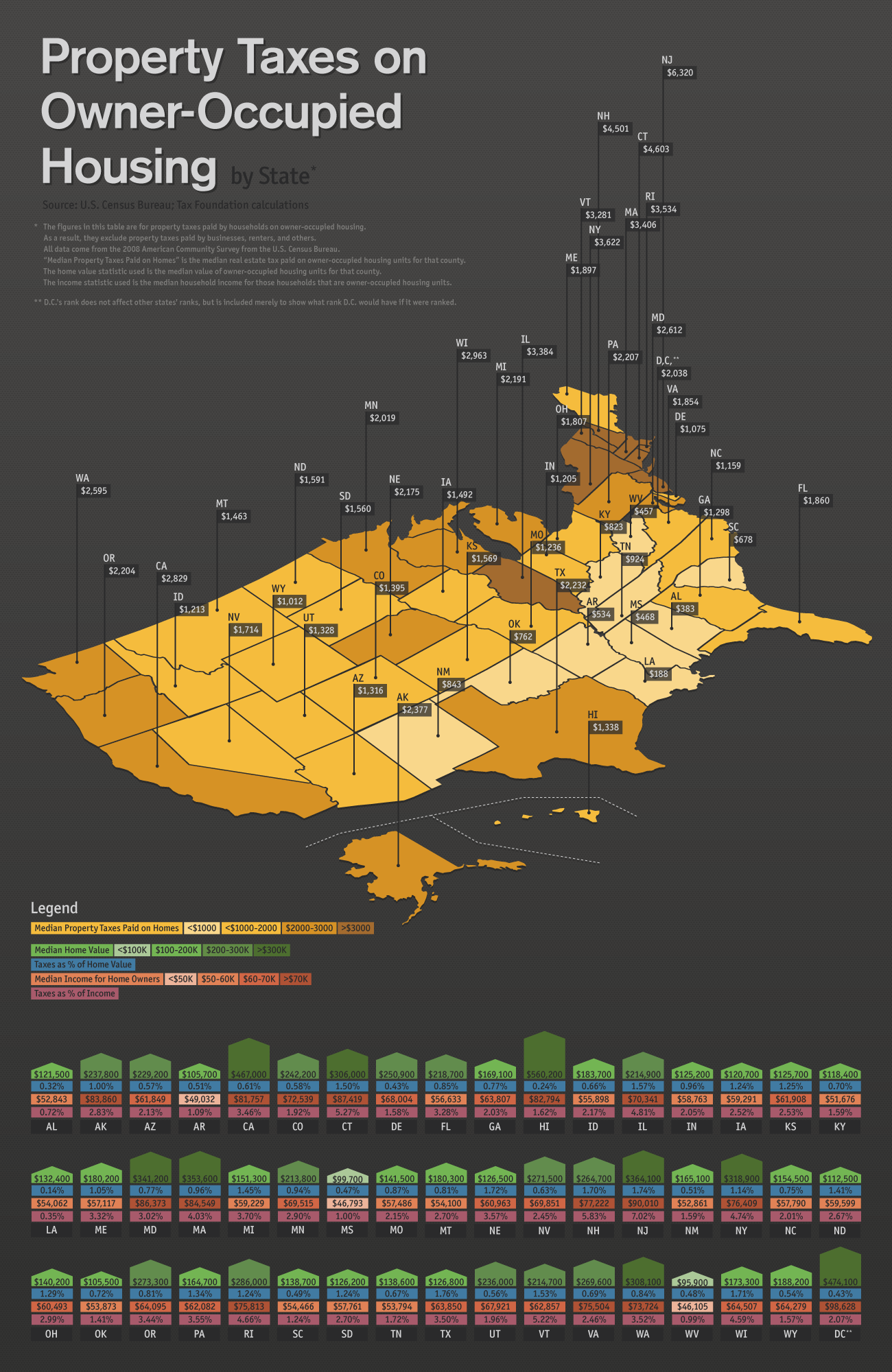

Median household property tax by Credit Loan.

The median reflects the mix of houses, local school districts, government spending, expenses, etc. So the average for NYS at $3600 reflects inexpensive homes with modest taxes, and a smaller percentage of expensive hoems with taxes 5X and 10X the median.

>

What's been said:

Discussions found on the web: