Do Student Loans Make Eduction Affordable ?

You just assumed they did. It turns out to be a far seedier picture, if you ask College Scholarships.org!

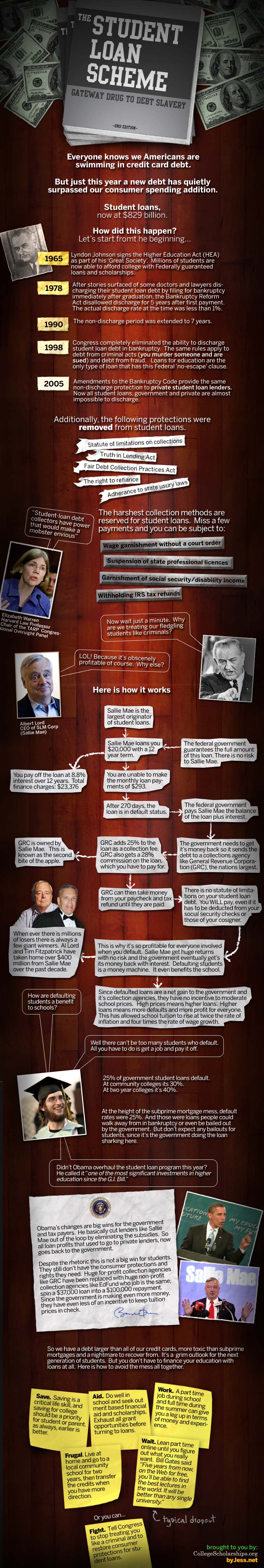

Jess Bachman, who did several of the fantastic illustrations for Bailout Nation, turns his attention to this infographic of the scam that is Student Loan collections:

>

What's been said:

Discussions found on the web: