The law of unintended consequences has made decimalization part of the problem. Once trade execution went from a profitable business to an all risk, no upside business segment, the carbon units were quickly replaced with much cheaper silicon. Once the (profitable) fractions were lost, robotization was inevitable.

In my wish list of “Impossible Wall Street Fixes,” I rooted for the return of fractions.

8. Decimalization: Give up the decimals, and return to fractions. This would allow investment houses trading desks to earn a decent profit. And that might reduce their need for reckless speculation.

Somewhere between fractions and decimalization is an even simpler fix: Nickel Increments.

Here’s Mike Santoli:

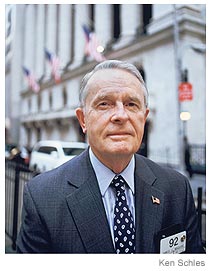

“Take, for instance, a gentleman named Jim Maguire, who began working as a specialist on the New York Stock Exchange floor 60 years ago, who acted for many years as the nexus point for buyers and sellers of Berkshire Hathaway (ticker: BRKA) shares, and who is now associated with Barclays Capital.

Jim recently refreshed his longstanding campaign to have stocks trade in increments of five cents rather than pennies, which could bring greater liquidity and order to the process. Trading has become faster and cheaper in recent years, but at the expense of squandering much of the public’s faith in how the stock market operates.

Barron’s featured Jim’s cause several years ago (“Meet Mr. Nickel,” April 25, 2005), and he just recently sent a letter articulating his position to Securities and Exchange Commission Chairman Mary Schapiro.

Schapiro, in turn, has lately given voice to the sensible notion that typical high-frequency traders, who profess with plenty of justification to be “de facto market makers,” should perhaps be subject to the traditional obligations of literal market makers—such as not being able to back away from bids and offers.

There aren’t many rigid principles Wall Street folks are obliged to follow. But one of them should be that a person who has spent six decades of his life advocating for the position that the public deserves a fair shot—and who has earned, and declined, the right to walk away from the market at a ripe age with a sense of a career well done—should be listened to.

I like the idea a lot.

I wonder what unintended consequences would come out of reverting to 5 cent pricing . . .

>

Source:

Faster, Cheaper and Fairer

MICHAEL SANTOLI

Barron’s OCTOBER 2, 2010

http://online.barrons.com/article/SB50001424052970204839304575520063527174210.html

What's been said:

Discussions found on the web: