Do underwater homeowners have a zero cost option on future movement of home prices?

That seems to be the conclusion of the SF Fed, who note that for the upside-down borrower, there is merit in staying put. “Given the importance of falling house prices as a factor in defaults, it is natural to ask how far they must drop before it serves the borrower’s rational interest to strategically default, that is, to walk away from a mortgage even in the absence of a life event.”

The SF Fed has left out one other important factor that determines whether the “owner” will strategically default: Alternative rental costs of similar or identical housing.

To this borrower, the ability to go down the block to rent a similar home at half the monthly price is a powerful incentive. One can hypothesize an entire neighborhood of post foreclosure rentals with each former owner renting the house to the immediate left of their prior home. Everyone (except the lender) wins!

If the Fed wants to determine whether someone might strategically default, I suggest looking at the state of the local rental market. If it provides competitive housing a much lower price points, you have the financial incentive to offset free option on home price directions.

Regardless of that omission, the charts are still powerful. Though we have seen these previously, they still have the power to astonish:

>

What a difference a decade makes:

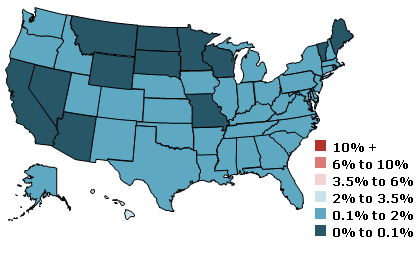

Underwater Homes, Q4 2000

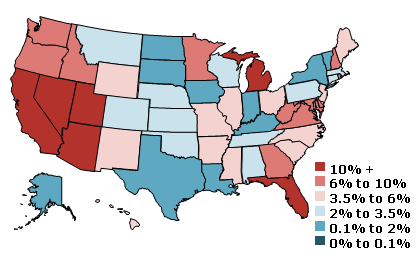

Underwater Homes, Q4 2009

Excerpt:

Given the importance of falling house prices as a factor in defaults, it is natural to ask how far they must drop before it serves the borrower’s rational interest to strategically default, that is, to walk away from a mortgage even in the absence of a life event. A common answer is that house prices must fall to a point where the value of the house is less than the remaining loan balance, or when the house is “underwater” (see Thaler 2010, for example). The map in Figure 1 estimates the incidence of underwater first-lien mortgages in 2000. We do not know the actual values of the underlying properties backing these mortgages, but we can estimate the loan-to-value ratios by applying regional house price indexes to the appraised values of the houses at mortgage origination. In 2000, underwater borrowers were a rarity. The share of such borrowers exceeded 2% in just one state—Hawaii. The actual default rate, defined as the incidence of mortgages 60 days past due or in foreclosure, was about 2%.

The 2010 underwater mortgage map in Figure 2 looks very different. Over the intervening period, underwriting standards had shifted and lenders had become more willing to extend mortgages to borrowers who made small down payments. House prices also fell dramatically. The combination of small initial equity stakes and falling house prices produced a sharp jump in the proportion of underwater mortgages. In California, Florida, and Nevada, more than 20% of mortgages presently have principal balances that are greater than the estimated home values.

>

Source:

Underwater Mortgages

John Krainer and Stephen LeRoy

FRBSF Economic Letter 2010-31

October 18, 2010

http://www.frbsf.org/publications/economics/letter/2010/el2010-31.html

What's been said:

Discussions found on the web: