Mike Konczal of RortyBomb puts together a spectacular series of flow charts that explain in the simplest of terms how the bank foreclosure process went off of the rails, in Foreclosure Fraud For Dummies.

>

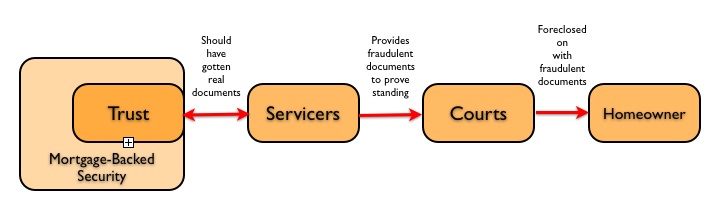

How Courts Process Foreclosures

>

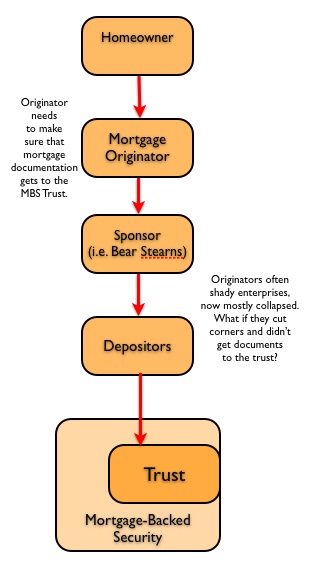

Errors Began in the Syndication Process

>

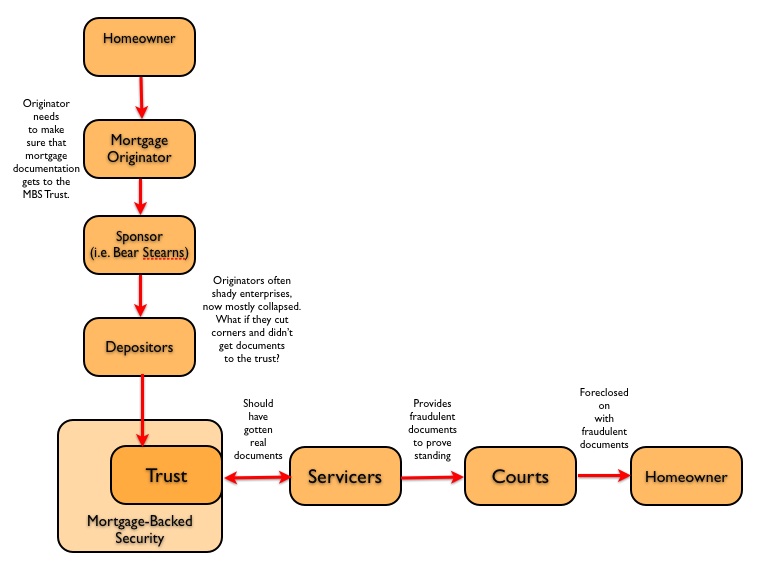

From A-Z, Fraud is Endemic in the Entire Process

Read his full piece.

>

Source:

Foreclosure Fraud For Dummies, 1: The Chains and the Stakes

Mike Konczal

RortyBomb, October 8, 2010

http://rortybomb.wordpress.com/2010/10/08/foreclosure-fraud-for-dummies-1-the-chains-and-the-stakes/

Previously:

Man without Mortgage Loses Home in Foreclosure (September 23rd, 2010)

Florida’s Ongoing Foreclosures Nightmare (September 29th, 2010)

How ‘Flawed’ Is Foreclosure Paperwork? (October 4th, 2010)

Foreclosure Fraud Reveals Structural & Legal Crisis (October 5th, 2010)

See also:

Officials in 40 States May Join in Foreclosure Probe (Bloomberg)

The Next Step in the Foreclosure Investigations (NYT/Dealbook)

What's been said:

Discussions found on the web: