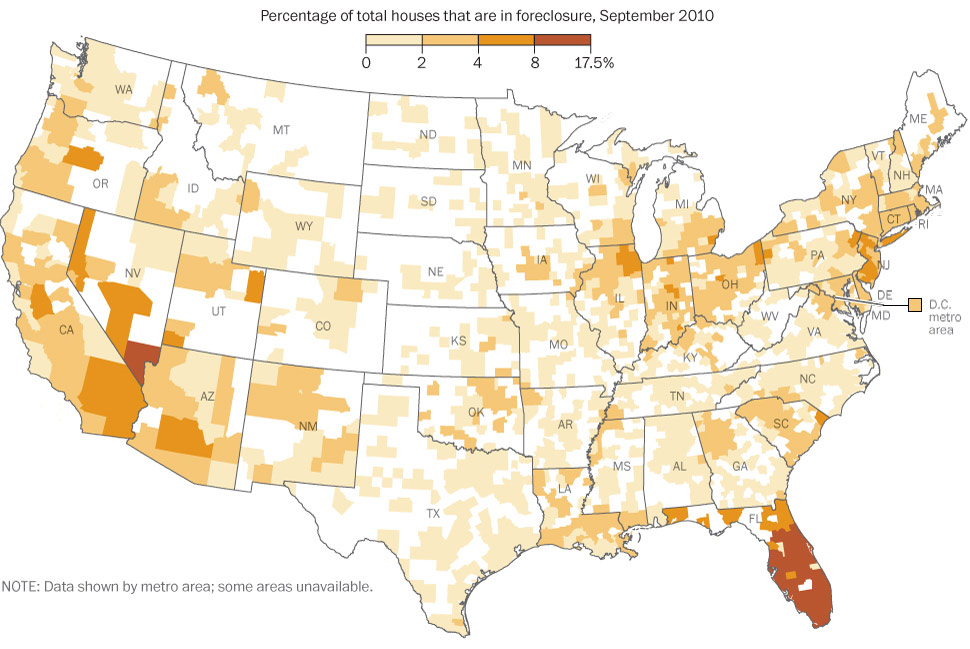

Here is a fascinating graphic from the Washington Post about where in the US, by County, foreclosures have taken place, color coded by percentage.

It is rather remarkable:

>

click for larger graphic

Map courtesy of the Washington Post

Foreclosure data from CoreLogic | Cristina Rivero and Mary Kate Cannistra/The Washington Post

~~~

And with this post, we add the category Foreclosures, rather than select Credit/Legal/Real Estate each time . . .

What's been said:

Discussions found on the web: