>

Laurie Goodman and the Amherst Securities Group tries to determine the size and scope of the housing problem:

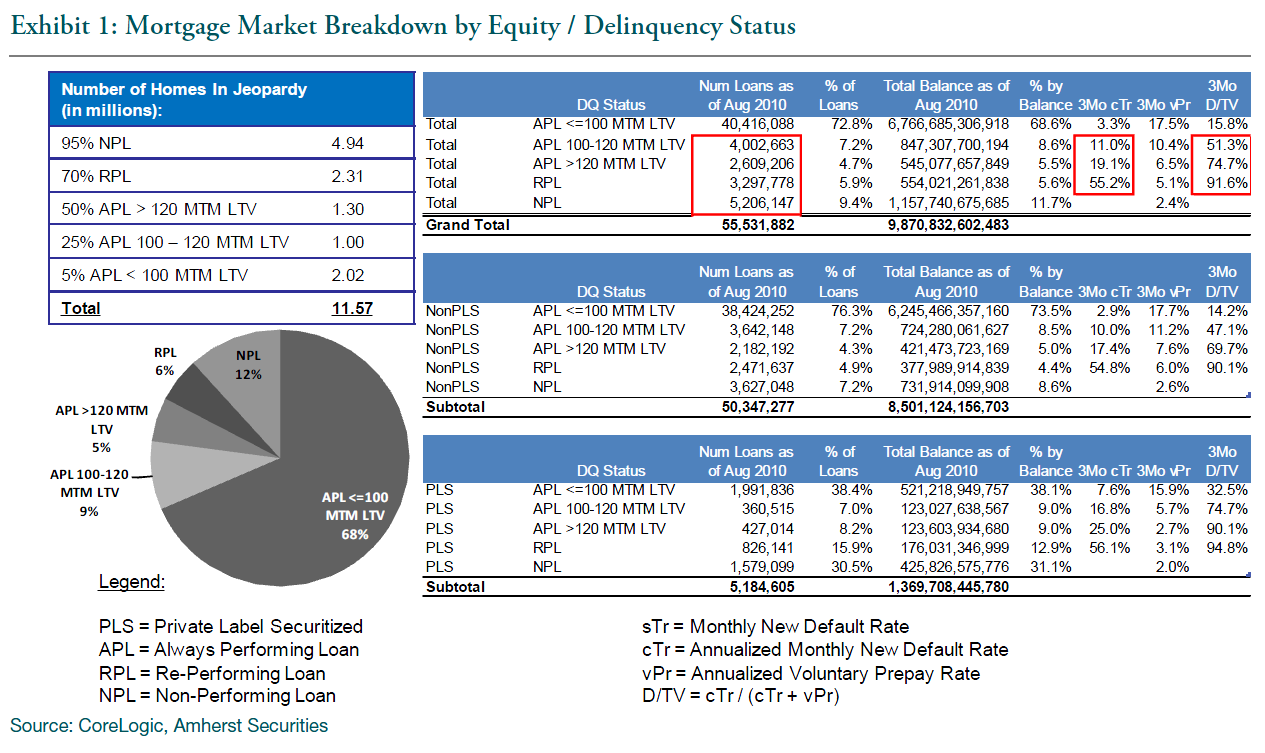

This article summarizes the size and scope of the housing crisis, making the point that if governmental policy does not change, one borrower out of every 5 is in danger of losing his/her home. A crisis of this order of magnitude requires both supply and demand side measures. On the supply side, a successful modification is critical. This will require principal reductions to re-equify the borrower. The moral hazard (strategic default) issues must be addressed by first recognizing that this is an economic issue, not a moral one. Second liens must also be addressed. As supply side measures alone are likely to prove insufficient to address a crisis of this size, we discuss demand side measures to increase the buyer base.

The full report, if you can track it down, is here and worth reading.

>

Source:

The Housing Crisis—Sizing the Problem, Proposing Solutions

Amherst Mortgage Insight, October 1, 2010

http://www.politico.com/static/PPM170_101006_amherst.html

What's been said:

Discussions found on the web: