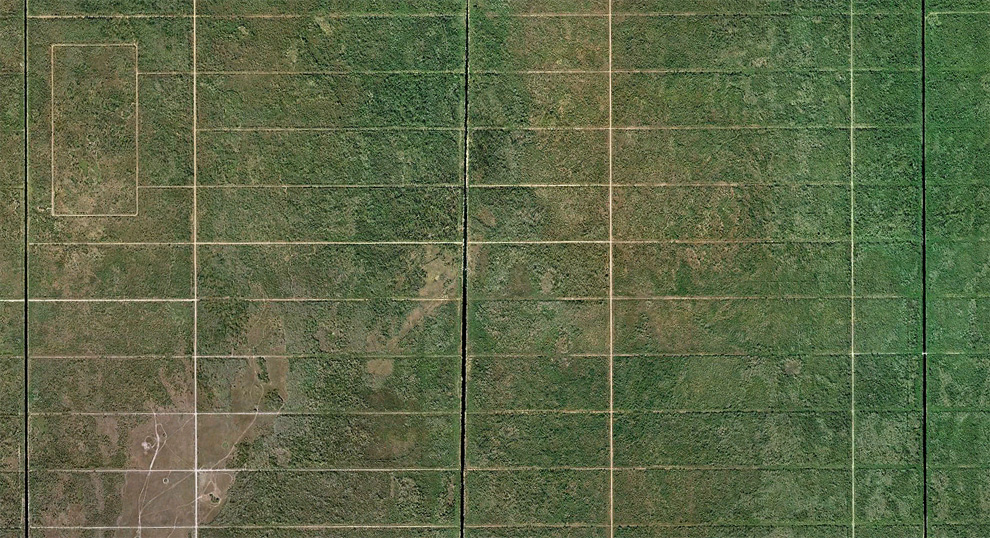

Fantastic set of aerial photos from Google Images (by way of Boston.com’s Big Picture), showing Florida’s developmental disaster.

The images of half finished (and barely started) developments are strangely beautiful, with a geometric symmetry that belies the state of human misery these developments represent: Lost deposits, bankruptcy, misallocated capital.

That an entire nation can be so innumerate as to believe in a mathematical fallacy is weirdly fascinating . . .

>

Florida Housing Bust

More images after the jump . . .

What's been said:

Discussions found on the web: