>

The MSM article of the day is a NYT takedown of JP Morgan’s raping and pillaging of various cities and pension funds. The accusation: Shared profits, client’s losses. When hedge funds do this, the private placement memorandum covers the terms. It is less clear that a brokerage firm can do this legally.

This follows Matt Taibbi’s March 2010 takedown of similar JPM misdeeds, Looting Main Street.

NYT Excerpt:

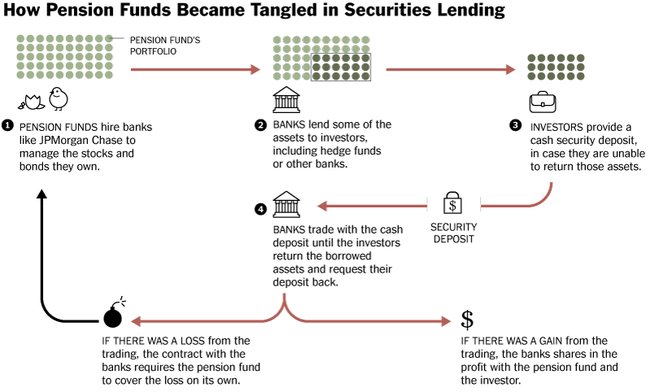

Here is the deal: Funds lend some of their stocks and bonds to Wall Street, in return for cash that banks like JPMorgan then invest. If the trades do well, the bank takes a cut of the profits. If the trades do poorly, the funds absorb all of the losses.

The strategy is called securities lending, a practice that is thriving even though some investments linked to it were virtually wiped out during the financial panic of 2008. These trades were supposed to be safe enough to make a little extra money at little risk.

JPMorgan customers, including public or corporate pension funds of I.B.M., New York State and the American Federation of Television and Radio Artists, ended up owing JPMorgan more than $500 million to cover the losses. But JPMorgan protected itself on some of these investments and kept millions of dollars in profit, before the trades went awry.

How JPMorgan won while its customers lost provides a glimpse into the ways Wall Street banks can, and often do, gain advantages over their customers. Today’s giant banks not only create and sell investment products, but also bet on those products, and sometimes against them, putting the banks’ interests at odds with those of their customers. The banks and their lobbyists also help fashion financial rules and regulations. And banks’ traders know what their customers are buying and selling, giving them a valuable edge.

Some of JPMorgan’s customers say they are disappointed with the bank. “They took 40 percent of our profits, and even that was O.K.,” said Jerry D. Davis, the chairman of the municipal employee pension fund in New Orleans, which lost about $340,000, enough to wipe out years of profits that it had earned through securities lending. “But then we started losing money, and they didn’t lose along with us.”

How did an industry that began by servicing their clients end up as an industry that only robs them? When I was coming up, financial services were a noble way to help people save for retirement; it appears to have morphed into something entirely different . . .

See related video here.

>

Source:

Banks Shared Clients’ Profits, but Not Losses

LOUISE STORY

NYT, October 17, 2010

http://www.nytimes.com/2010/10/18/business/18advantage.html

What's been said:

Discussions found on the web: