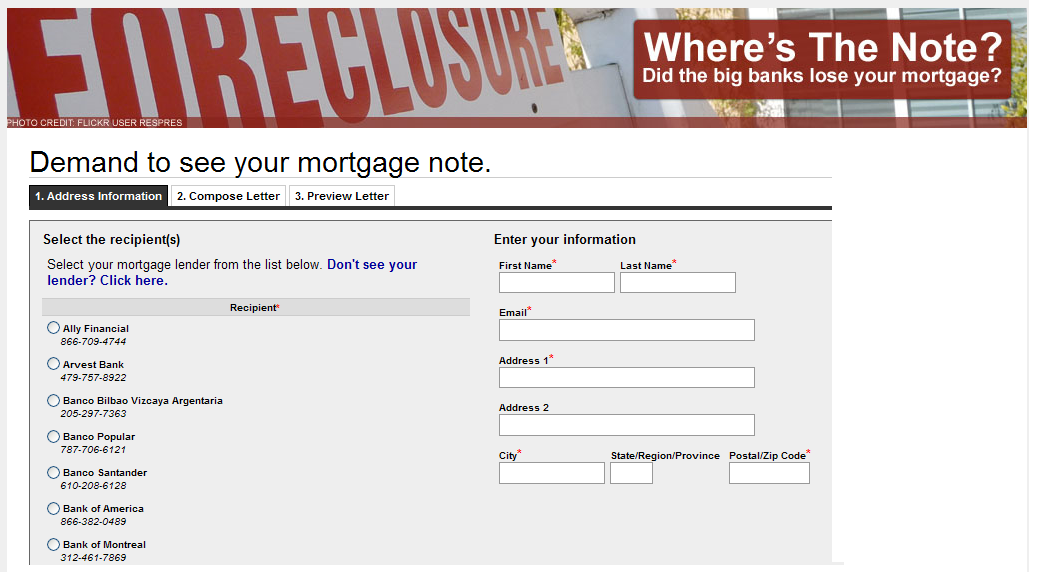

A site (gone viral) that allows homeowners to request to find out who actually owns their mortgage note:

“When Wall Street banks securitized, packaged, sold, and resold mortgages, they created a system where it is often impossible to figure out who actually owns mortgage notes and therefore has the authority to foreclose on properties. But the big banks are getting tangled up in their own web. Recent events have exposed a handful of banks that are throwing families out of their homes even though they don’t have the mortgage note that proves they actually have a legal right to do so. There have been instances of two banks trying to foreclose on the same home, and in at least two cases, of a bank trying to foreclose on a house where the homeowner had never even taken out a mortgage with anyone in the first place.”

>

What's been said:

Discussions found on the web: