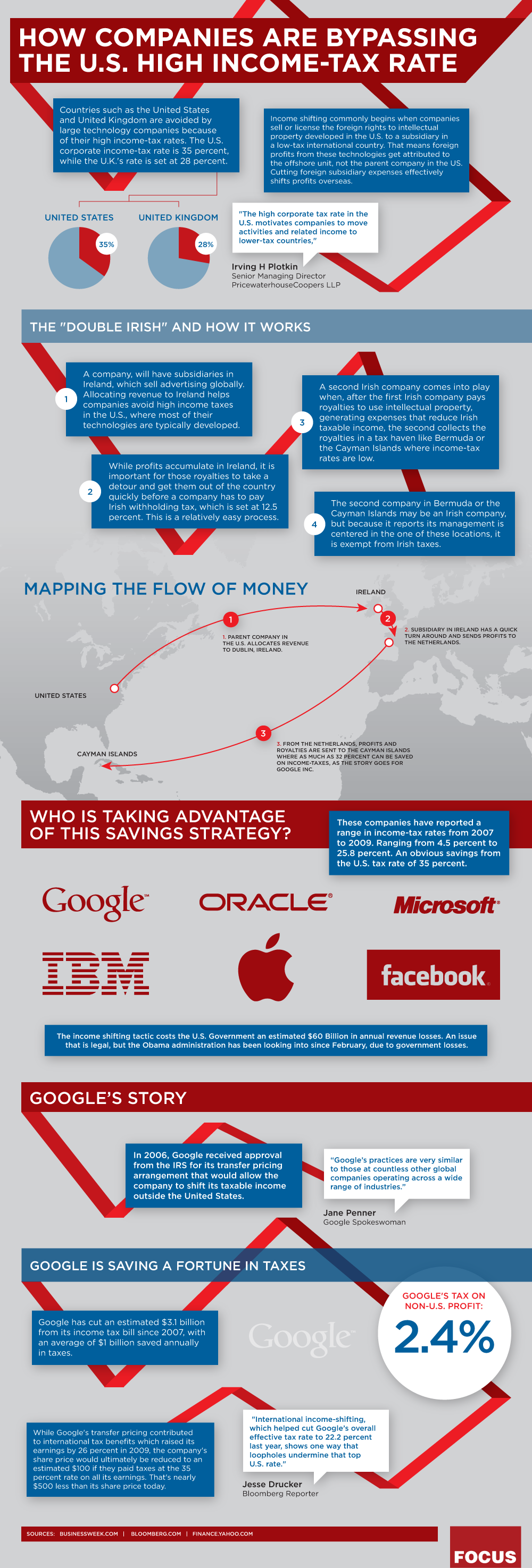

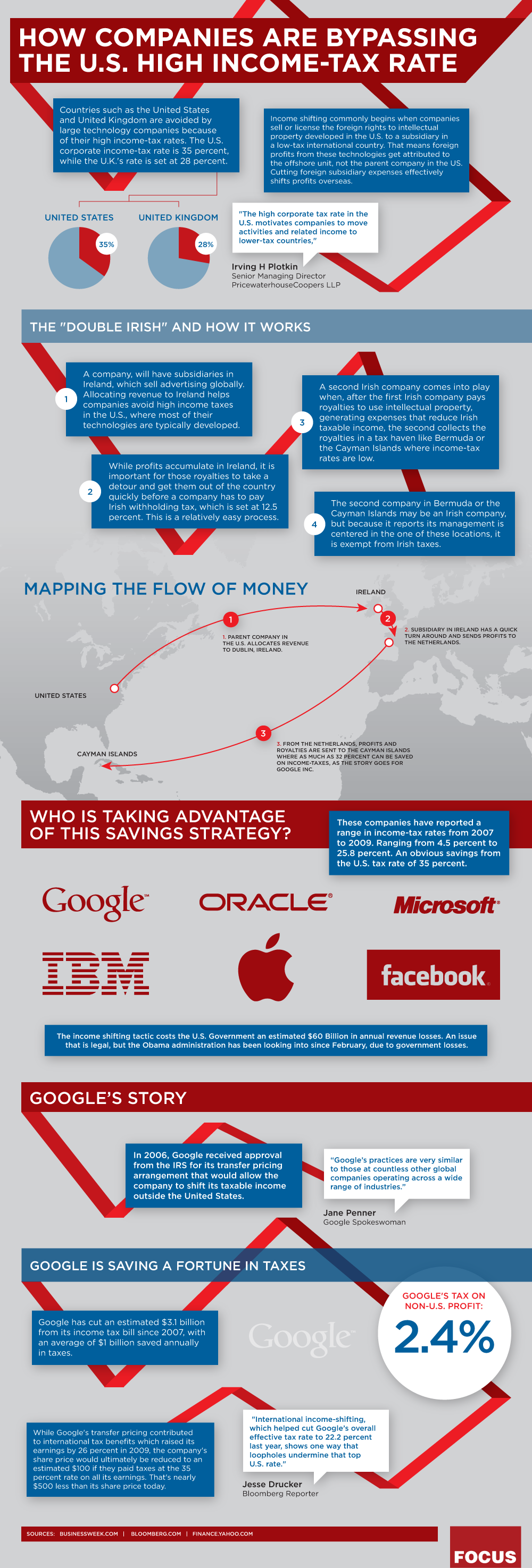

How various tech companies bypass paying US and UK tax rates.

And, its all legal . . .

Click for ginormous graphic

Source: Focus

How various tech companies bypass paying US and UK tax rates.

And, its all legal . . .

Click for ginormous graphic

Source: Focus

Get subscriber-only insights and news delivered by Barry every two weeks.

What's been said:

Discussions found on the web: