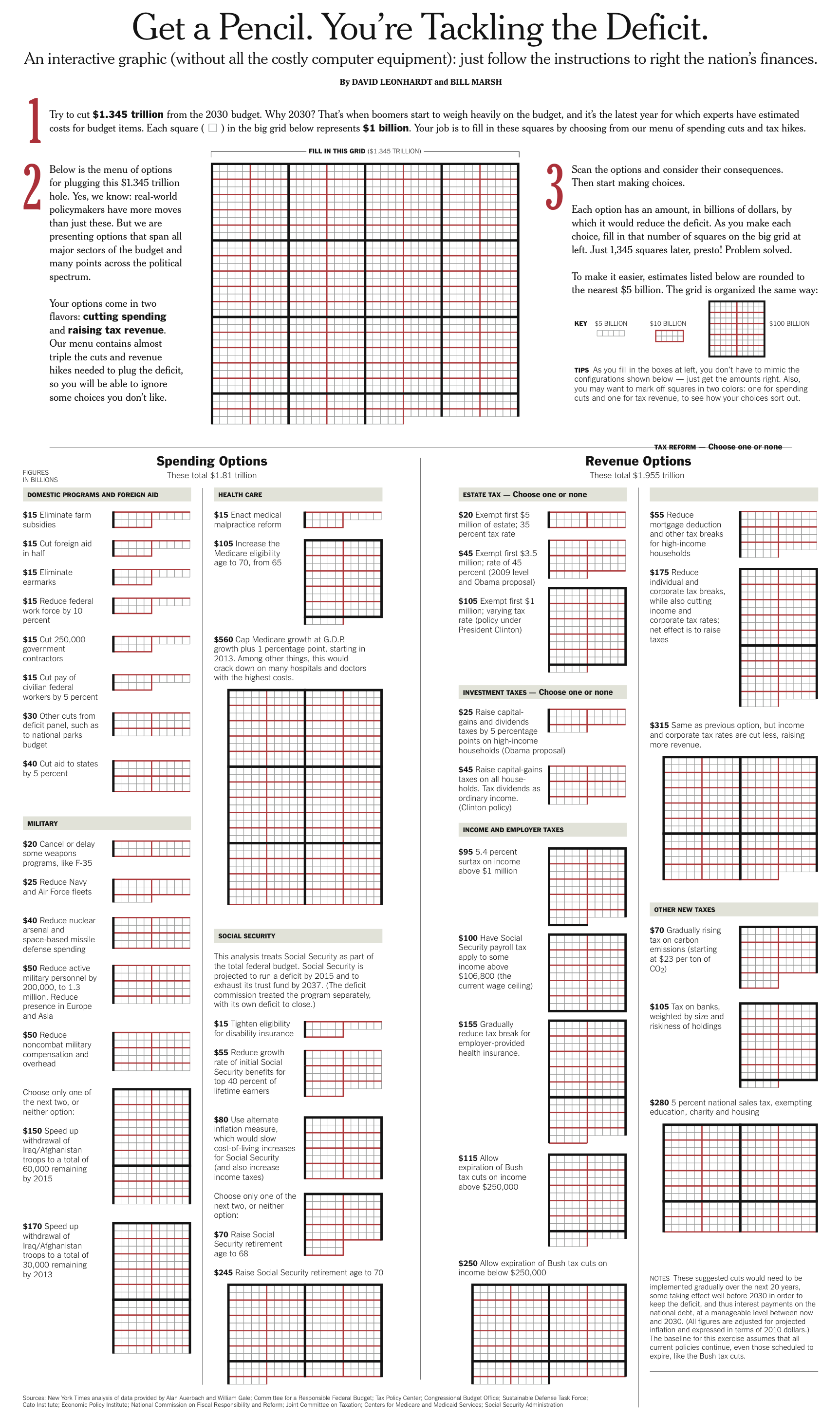

David Leonhardt gives us this interesting interactive NYT graphic (and article) showing the deficit reduction options. They give you a worksheet and various options to reduce the deficits:

Here is how I “solved” the shortfall — 61% of the fix are spending cuts, 39% of it was more taxes:

>

Budget Puzzle: You Fix the Budget

Try it yourself!

>

click for ginormous graphic (PDF here)

>

Of course, the discussion as to why we should be fixing the deficit in a mediocre recovery is not broached . . .

>

Source:

O.K., You Fix the Budget

DAVID LEONHARD

NYT, November 13, 2010

http://www.nytimes.com/2010/11/14/weekinreview/14leonhardt.html

What's been said:

Discussions found on the web: