The Wall St. Journal, and perhaps other outlets, published an open letter to Ben Bernanke pleading for the immediate discontinuation of QE2:

We believe the Federal Reserve’s large-scale asset purchase plan (so-called “quantitative easing”) should be reconsidered and discontinued. We do not believe such a plan is necessary or advisable under current circumstances.

The letter has 20+ signatories. It is noteworthy how outrageously wrong most of this team of incompetents were — on the recession, the credit crisis, and the markets; James Grant and Seth Klarman being notable exceptions.

Many of the names you will recognize (there are some I don’t) appear to have hard right conservative leanings. Paul Krugman takes down a couple of the signers, wondering what economic credentials William Kristol has (Or credentials of any sort for that matter).

Of course, one might level the same charge at another of the letter’s signers, former Bear Stearns economist David Malpass. BR has taken down Malpass here and here (to cite but two), but I don’t think Barry ever got to this one, in January 2008 (what we now know was the second month of the worst recession since the Great Depression):

Malpass’s message minimized the impact of both the ongoing U.S. housing recession and the credit crunch.

To an audience of guests representing top French financial institutions like BNP Paribas, Calyon and Natixis — all of which have been singed by the subprime crisis — Malpass sided with what appears to be a majority of U.S. economists in predicting that the U.S. economy would skirt the current crisis without falling into a formal recession.

“We will have a slowdown month by month for the next six months,” Malpass said. “But we will look back and we will say there was not a material recession.”

And here’s open letter co-author Kevin Hassett from the American Enterprise Institute (June 2008) in an article titled Seeing Recession When There’s None to Be Found, displaying near perfect partisan hackery, the lede of which was:

Are we in a recession? Despite what the media has led the public to believe, director of economic policy studies Kevin A. Hassett compares today’s economy to past recessions and finds that the current situation does not seem all that dire.

If a Democratic-leaning press can convince everyone that the economy is in recession, then it can influence the election. […] The politically motivated pessimism, like the computer virus, can have real consequences.

I’d be remiss if I didn’t also note that Mr. Hassett was co-author of the timely (November 2000) howler Dow 36,000.

A third co-author, Michael Boskin, also did not see the recession that was already staring us in the face (October 25, 2007, emphasis mine):

LAS VEGAS (MarketWatch) — Despite severe problems in the housing market, a credit crunch and record-high oil prices, the U.S. economy will skirt a recession in the coming few quarters and get back on a solid growth path after that, economist Michael Boskin told real estate industry executives Thursday at the Urban Land Institute fall conference.

Another co-author who is uniquely unqualified to discuss recession (or anything economic for that matter) is Amity Shlaes. Back in July 2008, while we were into the 8th month of the recession — just weeks before the entire financial edifice collapsed — Shlaes wrote a Washington Post OpEd, titled “Phil Gramm Is Right.” Shlaes was defending Gramm, who had said “the country was not in a true recession but a “mental recession.” He also said, “We have sort of become a nation of whiners. (Nice call, superlative timing).

Charles Calomiris is yet another co-author. Up until 2007, he was the codirector of AEI’s Financial Deregulation Project; he spent the years since trying to blame Fannie Mae/Freddie Mac for the collapse, insisting that radical deregulation had nothing to do with crisis.

Peter Wallison is Calomiris’ co-author on this WSJ OpEd: Blame Fannie Mae and Congress For the Credit Mess, as well as the QE letter. As prime proponents of the radical deregulatory scheme that contributed so mightily to the credit collapse, they have desperately sought some other McGinty to blame for the crisis — anything but their own fecklessness. Wallison is, for lack of another adjective, hallucinatory.

Also on the list: Cliff Asness of AQR Capital Management is another co-author. According to Bloomberg, his flagship Absolute Return fund went the wrong way three years ago, as the credit crisis was starting, falling more than 50%.

So how’d those calls work out? Many of the people who are criticizing the Fed Chief aren’t capable of seeing the worst recession in generations halfway through it; Why on earth should anyone care what their views on Quantitative Easing might be? These people should be working at Mickey Dees, not think tanks and hedge funds.

Is this a crew to which Bernanke should be paying any attention whatsoever? This is not a time for our economic policies to be hijacked by partisan ideologues who, frankly, don’t seem to be offering up any viable alternatives.

~~~

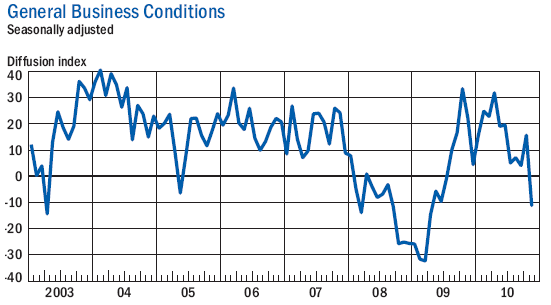

For what it’s worth, the Empire State Manufacturing Index printed this morning, and the number — along with most of the underlying components — simply tanked.

>

>

Empire State Manufacturing Survey:

The Empire State Manufacturing Survey indicates that conditions deteriorated in November for New York State manufacturers. For the first time since mid-2009, the general business conditions index fell below zero, declining 27 points to -11.1. The new orders index plummeted 37 points to -24.4, and the shipments index also fell below zero. The indexes for both prices paid and prices received declined, with the latter falling into negative territory. [Invictus: emphasis added]

A veritable trifecta of bad news — poor headline, crappy new orders and shipments, and disinflation/deflation in prices paid and received. Astute students of the economy will note that in “mid-2009” we were emerging from recession. We’ll see what we get out of Philly on Thursday morning, but the news out of NY is clearly not good. (Separately, Retail Sales were about as expected.)

Krugman rightly asks what the letter writers are modeling, and as best he can ascertain, it’s “wild stories about how Obama’s Sharia-law Marxism has unnerved business, or something, with the effects mysteriously spreading to Spain and Latvia.”

ADDING: Should anyone care — and I can’t fathom why anyone would — in the pre-recession era I was volunteering my services over at Blah3.com. Those who’d like to examine my public record in the fall of 2007 and early 2008 are invited to peruse these search results (or this Sept. 2007 post in particular: “The labor market — which Bush and his sycophants have repeatedly pointed to as evidence of our economy’s strength — is clearly showing signs of fatigue, and has been for some time (the vaunted 4.6% unemployment rate notwithstanding). Bush’s economic policies will have failed before the end of his term — with higher unemployment, insignificant wage growth, tax cuts for the rich, and a recession as his legacy. This much becomes more and more clear with each new economic data point we receive. The question now would seem to be how much the economy will slow and how deep the recession might be.”). Or view my entire body of work there, if you are having trouble sleeping.

SECOND ADD (Nov. 16): John Mauldin puts up a very interesting piece in the Think Tank, and in it essentially sums up my own thoughts: “If it had been my call, I would have punted and told the guys in the Capital that the ball was in their court to get their fiscal house in order, because that is the main source of the problem. But Bernanke and the Fed felt they had to “do something,” to demonstrate they got the seriousness of the situation. If the only policy tool you have left is the hammer of printing money, then the world looks like a nail.”

Previously:

The “Chutzpah” of Bear Stearns (August 7th, 2007)

Smackdown: Paul Kasriel vs Michael Boskin (September 10th, 2010)

Michael Boskin on “The Obama Crash” (December 7th, 2009)

Why Michael Boskin Deserves Our Contempt (January 19th, 2010)

What's been said:

Discussions found on the web: