Futures and commodities are sliding on the latest fears: There is widespread speculation that to quell its rising inflation, China will raise interest rates.

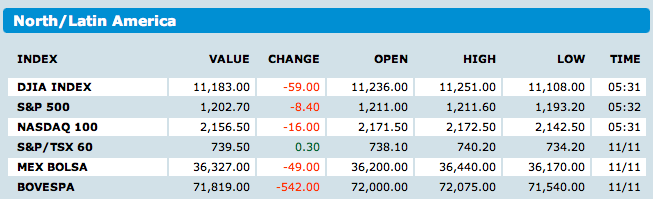

Asian markets were down: The benchmark Shanghai Composite Index fell 5.2% Friday, erasing nearly a quarter of the country’s three-month market upswing in a day. European Bourses slipped 1%. SPX Futures (see table below) are off nearly 3/4 of a percent.

Trading in the US the past few months has been very resilient. Despite numerous opportunities to go into a deep slide, equities have traded back to from the depths. We have not had a very negative day in some time — intraday lows are appreciably worse than closing prices.

The market is trading poorly, yet refuses to go down. There seems to be a firm bid beneath.

>

What's been said:

Discussions found on the web: