>

I frequently find myself disagreeing with Tobias Levkovich of Citigroup. That’s not surprising, given his firm and their investment posture.

Where I really part ways is on anything housing related. Levkovich was part of the mainstream herd of strategists who, as the markets topped in October 2007, made the erroneous forecast that Housing would not derail the economy or equities. He was also part of the decoupling crowd, and thus was was bullish about 2008 as late as March of that year.

But it call comes back to missing the credit bubble and the Housing boom and bust. Most of the mainstream strategists were guilty of that, and Citi’s top dog was no different. The big firm’s entire run of housing/market/economic calls were not exactly what you would call money-makers.

Which is why I am compelled the most recent comment of his that I disagree with: “The relative importance of housing to the consumer has been highly exaggerated.”

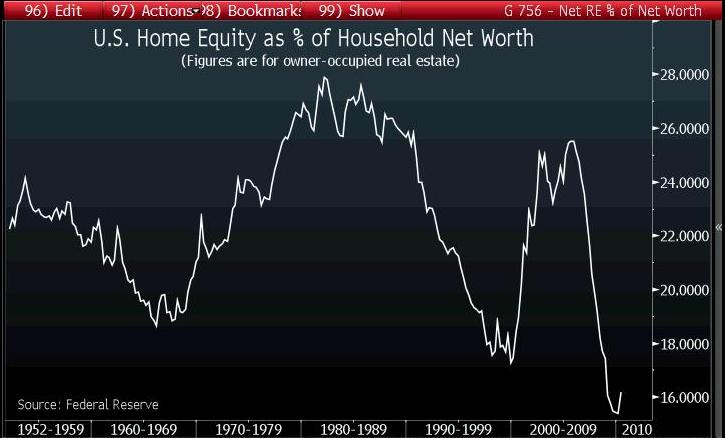

I find the above quantifiably false. From Bloomberg’s chart of the day:

“Levkovich drew the conclusion by tracking the equity in single-family homes and other owner-occupied real estate as a percentage of U.S. household net worth, using data compiled by the Federal Reserve.

As the CHART OF THE DAY illustrates, home equity accounted for 16.2 percent of net worth at the end of the second quarter, the Fed’s data showed. The first quarter’s figure, 15.4 percent, was the lowest in more than half a century.

Housing no longer has the effect on consumer confidence that it did when home prices were surging in the past decade, Levkovich wrote in an Oct. 29 report that included a similar chart. Equity in owner-occupied real estate peaked in the fourth quarter of 2005 at 25.5 percent of net worth.”

Um, no.

As that chart above shows, Housing as a percentage of Household net worth fell during the giant Bull market in equities from 1982 to 2000. The 2001-07 ramp up was artificially goosed by ultra low rates.

Two other factors to keep in mind when discussing the wealth effect:

1) The vast majority of Americans have very little money tied up in equities. The median family’s portfolio is worth well under $50k

2) The biggest investment remains real estate, with a median value of $200k. At 20% down, it still reflects 10 to 1 leverage.

Hence, why nationally, the wealth effects of real estate are far more than stocks . . .

>

See also:

COMPARING WEALTH EFFECTS: THE STOCK MARKET VERSUS THE HOUSING MARKET

Karl E. Case, John M. Quigley and Robert J. Shiller

COWLES FOUNDATION DISCUSSION PAPER NO. 1335

October 2001

http://cowles.econ.yale.edu/P/cd/d13a/d1335.pdf

Robert Shiller answers critics of housing “wealth effect”

Peter Coy

Bloomberg Businessweek July 06

http://www.businessweek.com/the_thread/economicsunbound/archives/2009/07/robert_shiller.html

Contra:

The (mythical?) housing wealth effect

Charles W. Calomiris Stanley D. Longhofer William Miles

VoxEU, 6 July 2009

http://www.voxeu.org/index.php?q=node/3734

What's been said:

Discussions found on the web: