The numbers are coming in, and so far, the Holiday shopping season is off to a very respectable beginning. Mall Traffic, retail sales, even dollar volumes are all up. In some areas, improvements have been quite significant. Online sales saw very large gains.

We do notice a variety of contradictions, binary conundrums and footnotes. We know the consumer has been deleveraging, but they are also suffering from Recession fatigue. (We also know that deleveraging is partly due to increased defaults).

Luxe items and high end retailers saw a post-recession improvement long before department and electronics stores, but they too are improving. What this trend means for discounters like Wal-Mart (WMT) and Dollar Stores (FDO, DLTR) has yet to be determined. It would not be a surprise if they failed to keep up with non discount gainers, as our “Retail Slumming” concept of 2007 may be seeing a partial unwind.

The data is encouraging:

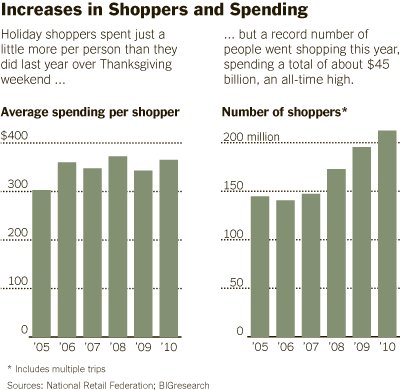

• Roughly 212 million shoppers visited a store or website over the weekend, an increase of 8.7% from last year, according to the National Retail Federation (WSJ)

• The average shopper spent $365.34, up 6.4% (WSJ)

• The heavy discounting and lower prices are holding down total retail sales spending in dollar total (AP)

• Black Friday weekend sales rise were estimated at 9.2% to $45 billion (NRF)

• Sales rose only slightly on Black Friday (ShopperTrak). This was attributed to a flurry of pre-Black Friday deals the preceding week

Online sales saw major gains. Part of this is the ongoing 15 year trend towards online retail; part of this reflects improving economic backdrop. The details:

• Sites saw spending up 9% to $648 million on Black Friday (comScore)

• Spending rose more than 14% from Thanksgiving Day through Saturday (IBM’s Coremetrics)

• For the first 26 days of November, online spending rose 13% to $11.64 billion vs 2009 (comScore)

• Thanksgiving Day e-commerce sales, typically a light day, rose to $407 million, up 28%

• ComScore is forecasting E-commerce sales in November and December to rise 11% to $32.4 billion. (Bloomberg)

This is encouraging, but incomplete. Retailers count on November and December for about 20% of their annual profits. Note that December 15-25 is believed to account for 40% percent of holiday business. Will consumers have the strength and the money to continue the momentum?

One last note: Most retail forecasts tend to be way too optimistic. We will find out if this is the year forecasters hit their marks.

>

Graphic courtesy of WSJ

Graphic courtesy of NYT

What's been said:

Discussions found on the web: