I first recommended GLD on Power lunch back in 2005. The Gold ETF was under $50, and the rec was greeted with widespread skepticism. The basis for the call was the 1% rate level that had set off a spiral of inflation in everything priced in US dollars or credit.

I first recommended GLD on Power lunch back in 2005. The Gold ETF was under $50, and the rec was greeted with widespread skepticism. The basis for the call was the 1% rate level that had set off a spiral of inflation in everything priced in US dollars or credit.

But I had no idea at the time of the history of how GLD came about. Today’s WSJ uncovers the tenuous beginning of the world’s largest private owner of bullion.

Here’s the WSJ:

“The innovation that opened gold investing to the masses and helped spur this year’s record-breaking bull market was hatched in an act of desperation by a little-known gold-mining trade group.

The World Gold Council, created to promote gold, was fighting for survival. Its members—global gold-mining companies—were frustrated with the council’s inability to stem two decades of depressed prices and find buyers for a growing glut of the yellow metal. Eight years ago, they were considering withdrawing funding from the trade group, a move that would have effectively shut it down…

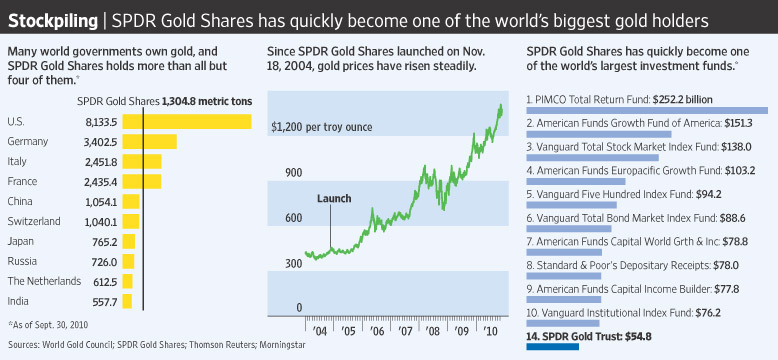

What the council eventually managed to create in those dark days surpassed its wildest dreams: SPDR Gold Shares, the exchange-traded fund launched in November 2004. The fund, known by its ticker symbol GLD, has ballooned into a $56.7 billion behemoth.”

The Journal tells the history of how the Gold Council launched the fumd, and the problems they had to overcome. Its well worth reading.

The one thing that I’d like to know about the various gold funds is how much physical Gold they own relative to paper gold, i.e., futures. Some estimates are that the demands on Gold relative to paper is a high multiple on the order of 100X. Does that mean the price is artificially juiced, or that demand outstrips supply? I’ve seen interesting arguments on both sides of the debate.

Here are some more GLD tidbits:

• The gold council spent $14 million developing the fund;

• GLD is the fastest-growing major investment fund ever.

• Asset value: $56.7 billion making it the 14th largest ETF.

• Revenue is a percentage of net asset value, set at 0.15%

• Its the world’s largest private owner of bullion

• GLD buys $30 million of gold daily

• All of the ETF bullion is stored in vaults in London

• GLD has now locked up nearly 1,300 metric tons of the world’s gold supply

• Estimate are gold-backed ETFs have added about $100 to $150 an ounce to the price of gold.

• Between 60% and 80% of GLD investors had never bought gold before;

>

>

Source:

Behind Gold’s New Glister: Miners’ Big Bet on a Fund

LIAM PLEVEN and CAROLYN CUI

WSJ, NOVEMBER 25, 2010

http://online.wsj.com/article/SB10001424052748703628204575618602535514506.html

What's been said:

Discussions found on the web: