There’s still great uncertainty about what direction financial regulation is going to take, particularly in view of Republicans’ newfound control of the House of Representatives. Back in July, headlines like this one, trumpeting replacing a “suitability” standard with a fiduciary standard, were a dime a dozen. (I won’t go into the differences between the two standards here.)

I believe one unintended consequence of setting the broker/dealer bar at “fiduciary” instead of “suitable” might well be a significant hit to the closed end fund (CEF) business, and here’s why:

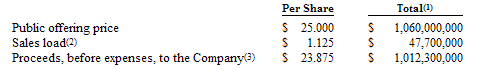

Take a look at this graphic, straight off the cover of a recent CEF (no names, as it really doesn’t matter), and let’s reconvene immediately below:

Every single financial advisor who committed clients’ funds to this CEF IPO plunked down $25 in cash in exchange for $23.875 in cash — which will remain in cash until the fund begins to scale into its investments under whatever its mandate might be. It is exactly for this reason that stablizing bids are used by underwriters for some period of time (usually up to 90 days) to support the price. That said, it’s just about a lock that once the stabilizing bid is removed, the price is going to drift down toward the Net Asset Value (NAV). Rare indeed is the CEF that does not break its issue price when the stabilization is removed. Which begs the questions: Why buy CEFs on the offering? Knowing it’s virtual certainty that a CEF will break its issue price, why not wait until it does so? Would/could buying a CEF on the offering be considered a breach of an advisor’s fiduciary duty? What compelling reason would there be to participate in the offering? Whatever the CEF investment, it may well be suitable for a given investor — of that there can be no doubt. But if the bar is raised to fiduciary, committing a client’s funds on the offering becomes, in my very humble opinion, less defensible, particularly given what we know about how the vast majority of CEFs trade in the short-term aftermarket.

Is anyone aware of a CEF that did not break its issue price in the first 2 – 4 months of trading? I’d be very interested in knowing.

What say ye? What am I missing?

What's been said:

Discussions found on the web: