My friend Paul Kedrosky and I were discussing the absurdity of pricing the market in Gold last week. Paul is “always uneasy about these ‘Let’s price Thing X in Commodity Y’ exercises. (See his chart of the Dow priced in gold since 1900 here).

I decided to take that to another level, and make my gold bug friends lose their minds: As we all know, Gold (atomic symbol AU) is a barbaric relic — and the only “True” currency in the world is Silver (atomic symbol AG). That’s right, Silver.

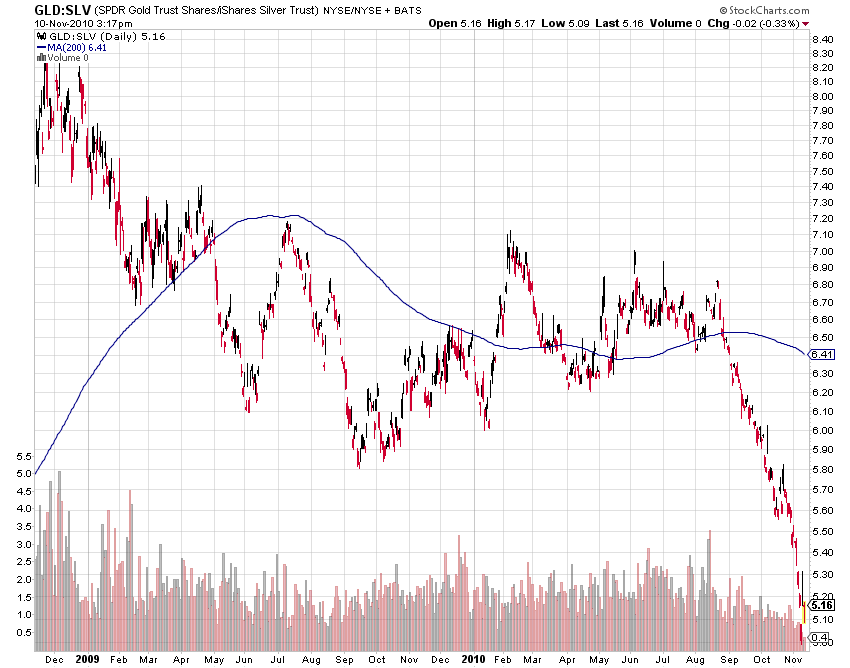

Proof of this is how poorly Gold has performed priced in Silver.

Its obvious from the chart below that Gold has no intrinsic value. Forget QE, the Gold Miners are doing QM Quantitative Mining. These irresponsible Miners are “printing gold” by scraping it out of the ground as fast as they can. They are debasing it as a store of value, and are no better than central bankers with their fiat currencies and printing presses.

Silver, not Gold should be the reserve currency of the world!

>

See how poorly Gold has performed priced in Silver

Source: Stockcharts.com

>

See also

Hey Gold Bugs, Don’t Forget About These Charts

Matt Phillips

MarketBeat, November 9, 2010

http://blogs.wsj.com/marketbeat/2010/11/09/hey-gold-bugs-dont-forget-about-these-charts/

What's been said:

Discussions found on the web: